With Abbott announcing the availability of its Amplatzer Steerable Delivery Sheath, Guidepoint Qsight took a closer look at the left atrial appendage closure market to assess how the launch of Abbott’s Amplatzer Amulet impacted Boston Scientific’s share.

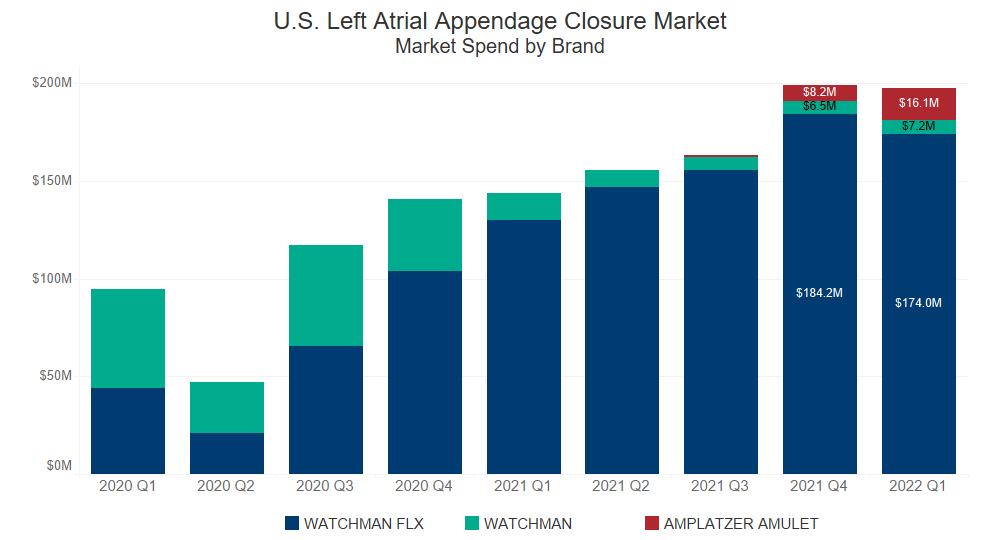

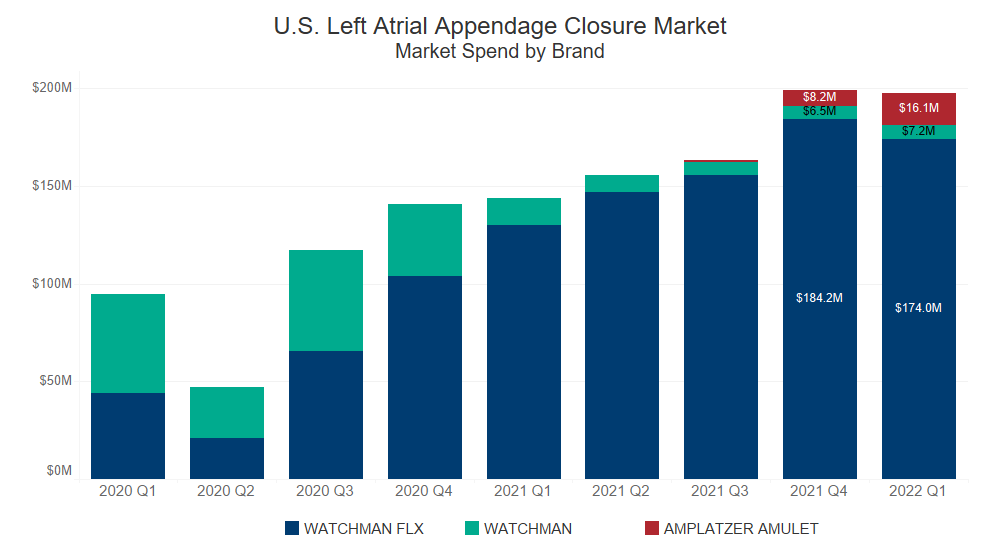

- The left atrial appendage closure (LAAC) market grew over 65% between CY 2020 and 2021 ($399.4M and $661.4M, respectively).

- Prior to September 2021, Boston Scientific’s Watchman was the only device in the LAAC market. However, after the introduction of Abbott’s Amulet in September 2021, the market grew substantially in the last two quarters.

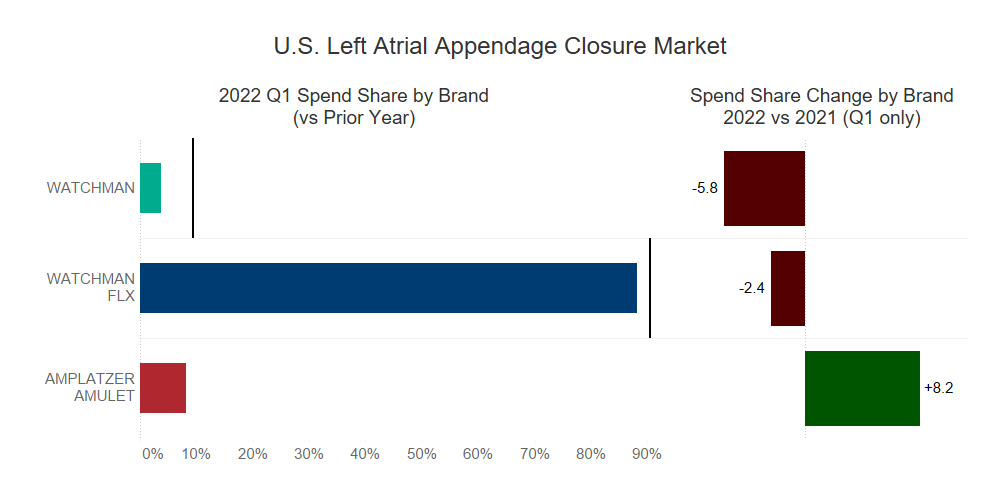

- When comparing 2022 Q1 to 2021 Q1, Amulet took 8.2% share of the market from Boston Scientific’s Watchman family.

- The question remains: Will Abbott be able to take meaningful share in this market, or will Boston Scientific regain ground?

The above is based on Qsight’s healthcare facilities purchasing dataset, analyzing over $5M in annual spend from the top 2 players in left atrial appendage closure devices across a panel of 2200+ distinct healthcare facilities and hospitals.

Post Created by Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight and Kenny Dolgin, Director of Quantitative Research, Guidepoint Qsight