Qsight’s medical device purchasing dataset captures trends in several markets, including the orthopedics market. We took a closer look at top manufactures in the orthopedics segment to figure out which players were contributing to and detracting from overall growth of the market.

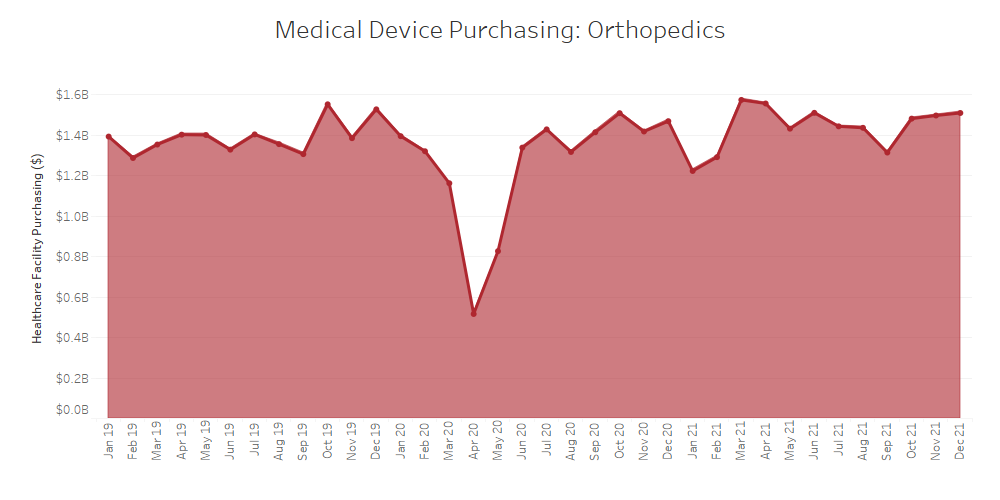

- Orthopedic procedures, largely elective, are more at risk to cancellations during the COVID-19 pandemic, experiencing lows and highs as cases rise and fall.

- After the initial plummet caused by the first COVID-19 related lockdown almost two years ago, the orthopedic market showed signs of recovery based on Qsight’s healthcare purchasing dataset.

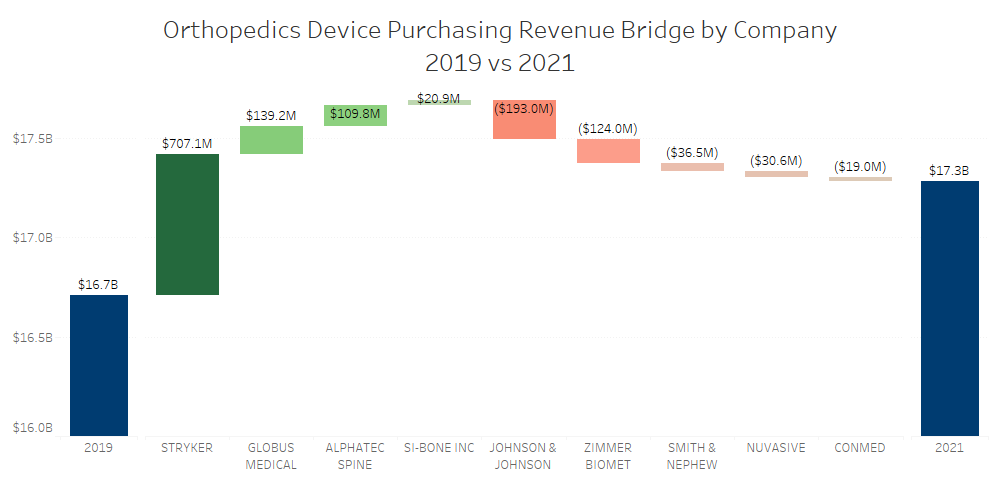

- When looking at growth within the orthopedics segment between 2019 and 2021, our healthcare facilities purchasing dataset reflected an increase of 3.4% ($16.7B to $17.3B), signaling towards market recovery and growth.

- Breaking it down by company, Stryker showed the greatest increase in revenue from 2019 to 2021 (+707.1M), while Depuy Synthes (Johnson & Johnson) and Zimmer Biomet experienced the greatest loss ($193.0M and $124.0M respectively).

The above is based on Qsight’s healthcare facilities purchasing dataset, analyzing over $15B in annual spend from the top 9 players in orthopedic medical devices across a panel of 2200+ distinct healthcare facilities and hospitals.

Post Created by Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight and Kenny Dolgin, Director of Quantitative Research, Guidepoint Qsight