Guidepoint Qsight is excited to announce the launch of a new Medical Aesthetics market intelligence offering where you can track the latest trends in the U.S. Medical Aesthetics space with insight into several categories, including Neurotoxins, Dermal Fillers, Non-Surgical Fat Reduction, Skin Tightening, Hormone Replacement Therapy, and several more.

We’ve used our Medical Aesthetics dataset to take a closer look at how the industry has changed since COVID-19.

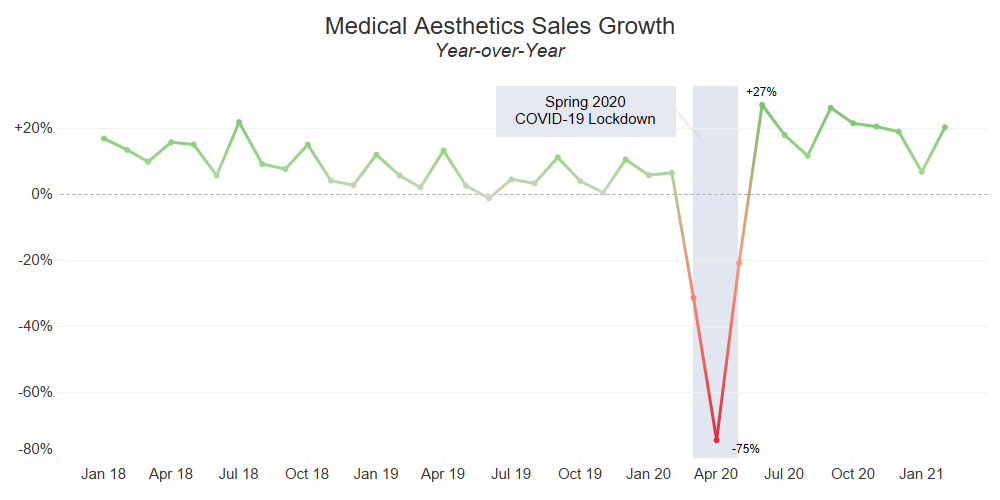

- Medical Aesthetics sales dropped 75% year over year in April 2020, as non-urgent and elective medical procedures took a backseat to COVID-19 patients.

- As physician facilities and med-spas reopened in June 2020, aesthetics sales surged higher than pre-COVID-19 lockdown levels due to the increased demand of backlogged patients.

While the aesthetics market is currently experiencing double-digit growth levels, there are still several questions that remain:

- Is this momentum in growth going to sustain long term?

- How did the patient demographics change after the initial COVID-19 lockdown (age, gender, geographic region, and procedure preferences)?

- What impact did COVID-19 have on total sales volume, and how did it impact the market share by company and procedure type?

Find out the answers to these questions and more using Qsight’s Medical Aesthetics dataset. Contact us for more information.

The above is based on Qsight’s new Medical Aesthetics dataset that analyzes over $500M in sales from over 1M transactions per year from hundreds of MedSpas and physician practices in the United States.

Post created by: Travis Deseran, Director of Quantitative Research, Guidepoint Qsight and Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight