With Shockwave surpassing Wall Street’s expectations with their third-quarter earnings, Guidepoint Qsight took a closer look at how their new C2 catheter has taken the Coronary Arterial Disease Device market by storm.

- In February 2021, Shockwave launched its C2 Coronary Intravascular Lithotripsy catheter, which is a device that helps open up calcified arteries to allow for stent implantation.

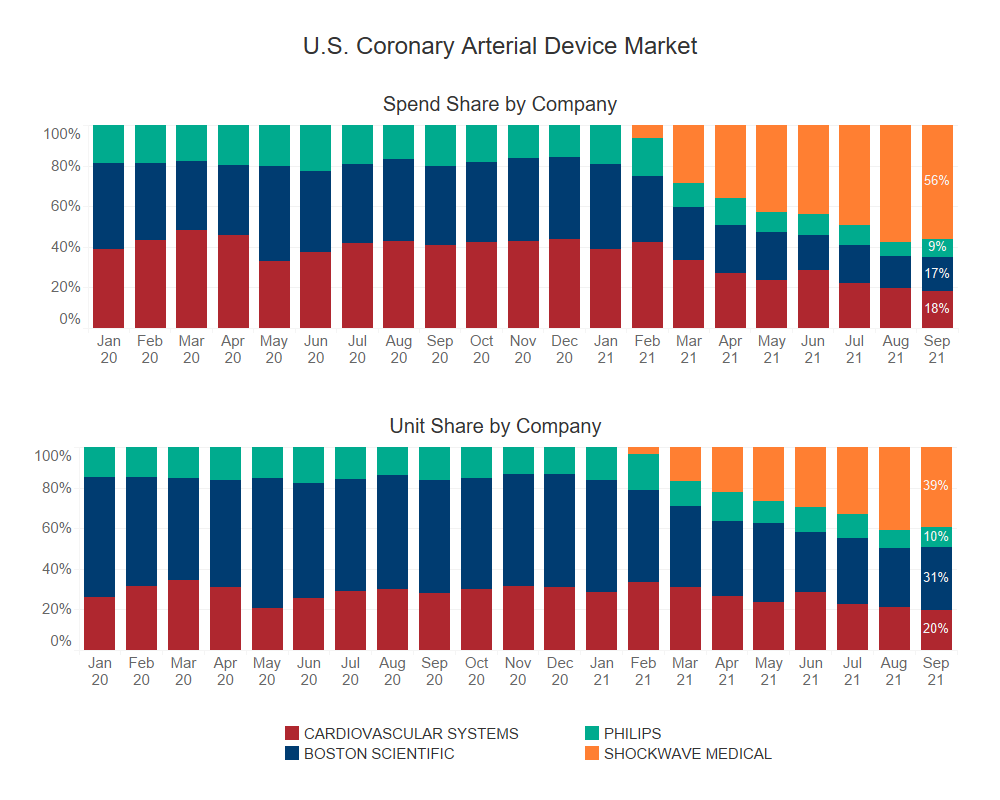

- Shockwave’s C2 rapidly captured significant market spend and unit share in the coronary arterial device market just eight months after its launch.

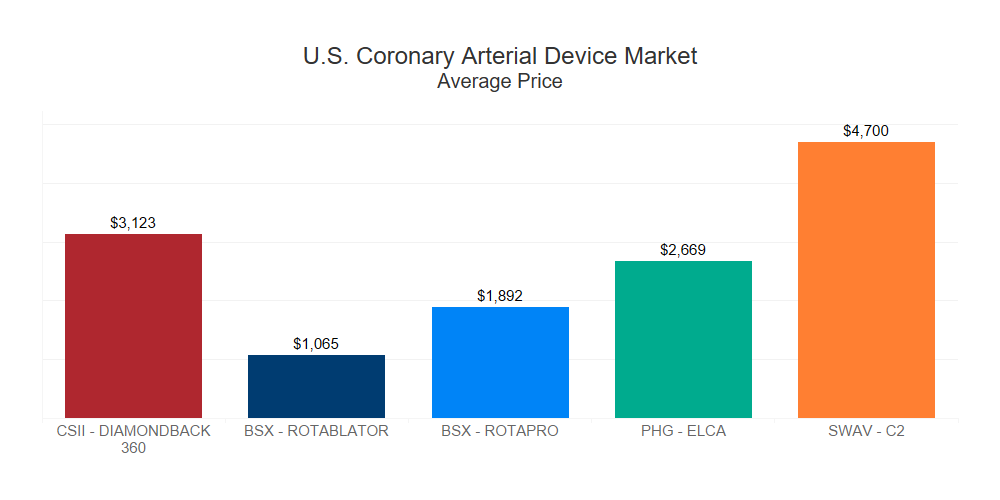

- When taking a closer look, Qsight’s healthcare facilities purchasing dataset found that C2 is priced at a premium compared to competing brands.

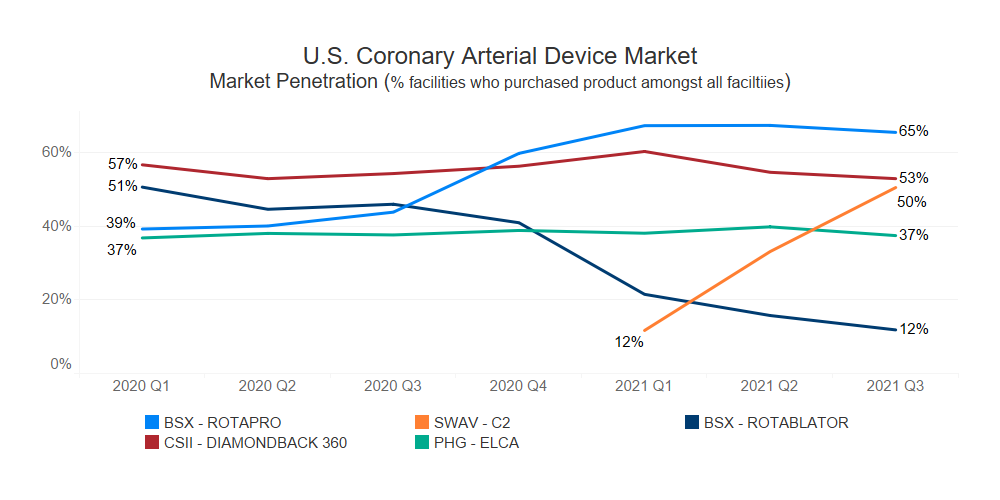

- Although Boston Scientific’s ROTAPRO Atherectomy System has been purchased by the greatest number of healthcare facilities, Qsight’s dataset shows that Shockwave’s C2 catheter increased market penetration from 12% to 50% in just eight months after its introduction to the market.

- Shockwave’s explosive gain in share is due to Shockwave’s C2 higher price point and a result of rapid market acceptance and adopted use.

- The question remains if Shockwave can continue this momentum and remain a market leader, stealing more share from legacy brands in the coronary arterial device market.

The above is based on Qsight’s healthcare facilities purchasing dataset analyzing over $150M from the four dominant players in the U.S. coronary arterial device market across a panel of 600+ distinct healthcare facilities and hospitals.

To access more information and insights like the ones above, request a demo here.

Post Created by Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight, and Kenneth Dolgin, Vice President of Quantitative Research, Guidepoint Qsight