The peripheral thrombectomy market in the United States has been witnessing significant growth and innovation in recent years. With new devices constantly entering the market, Qsight’s healthcare facilities purchasing data has been monitoring the impact of these new products.

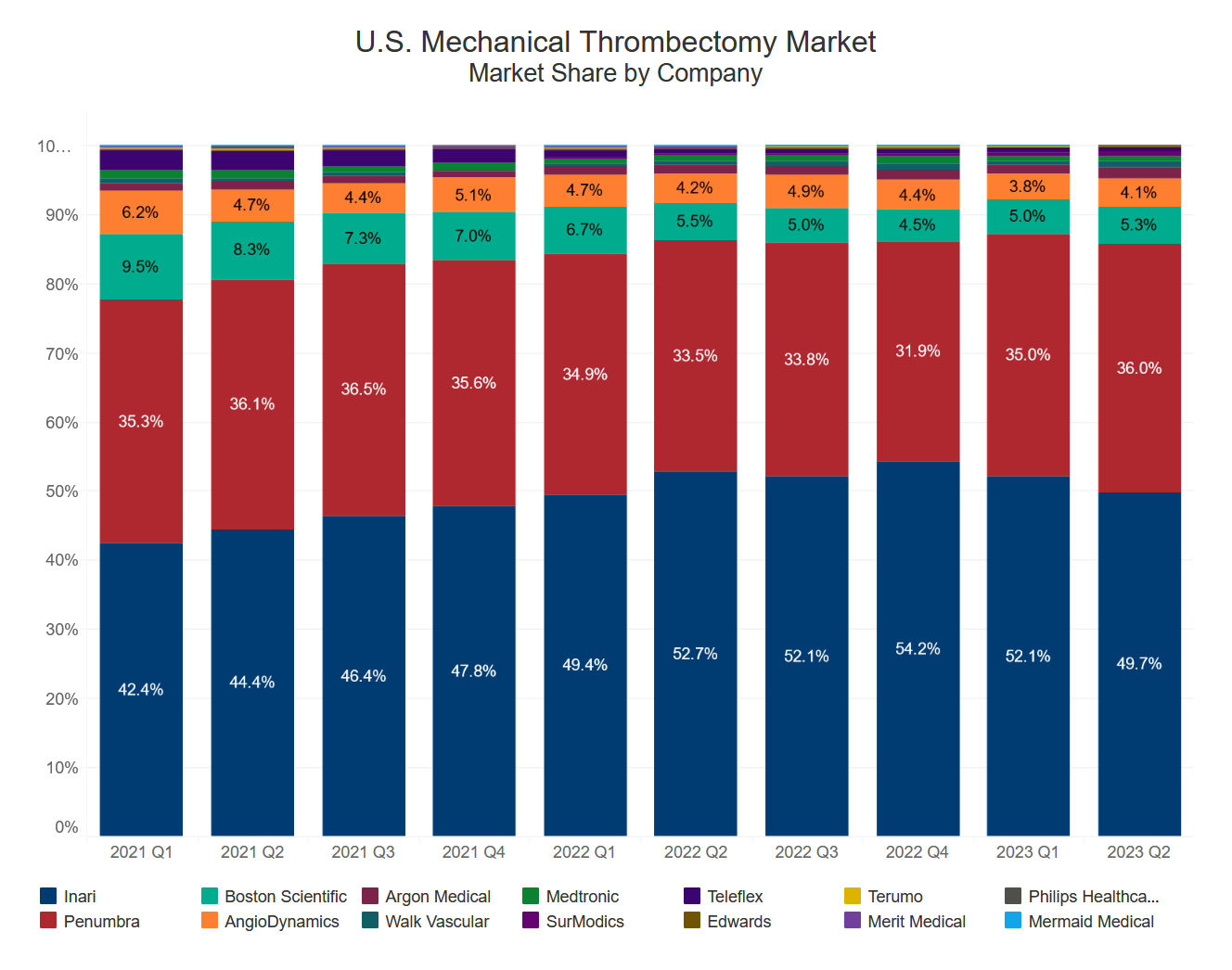

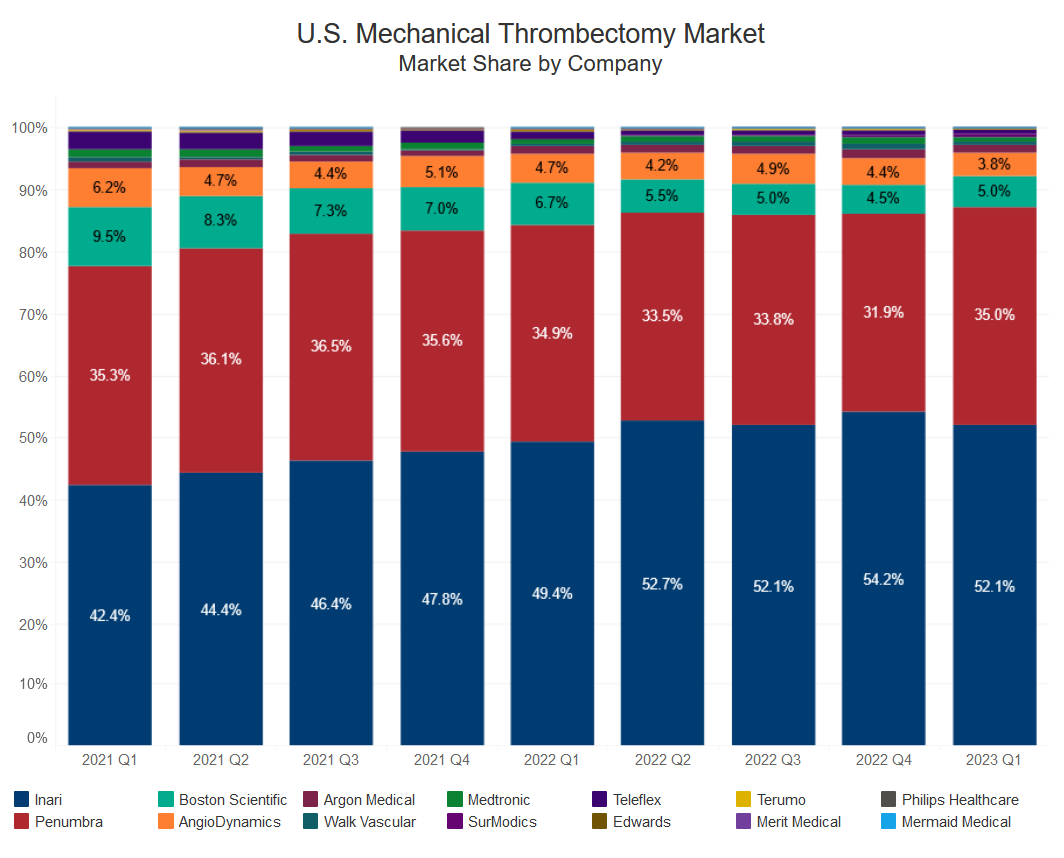

Although there was a slight downtick in Inari’s market share from 2022 Q4, the company continues to dominate the mechanical thrombectomy market, commanding 51.5% of the total market share in 2023 Q1. Notably, Penumbra underwent a remarkable expansion in its market presence, outpacing the previous quarter by an impressive margin of 3.1%, thereby solidifying its position in the industry. (35.0% in 2023 Q1 vs 31.9% in 2022 Q4).

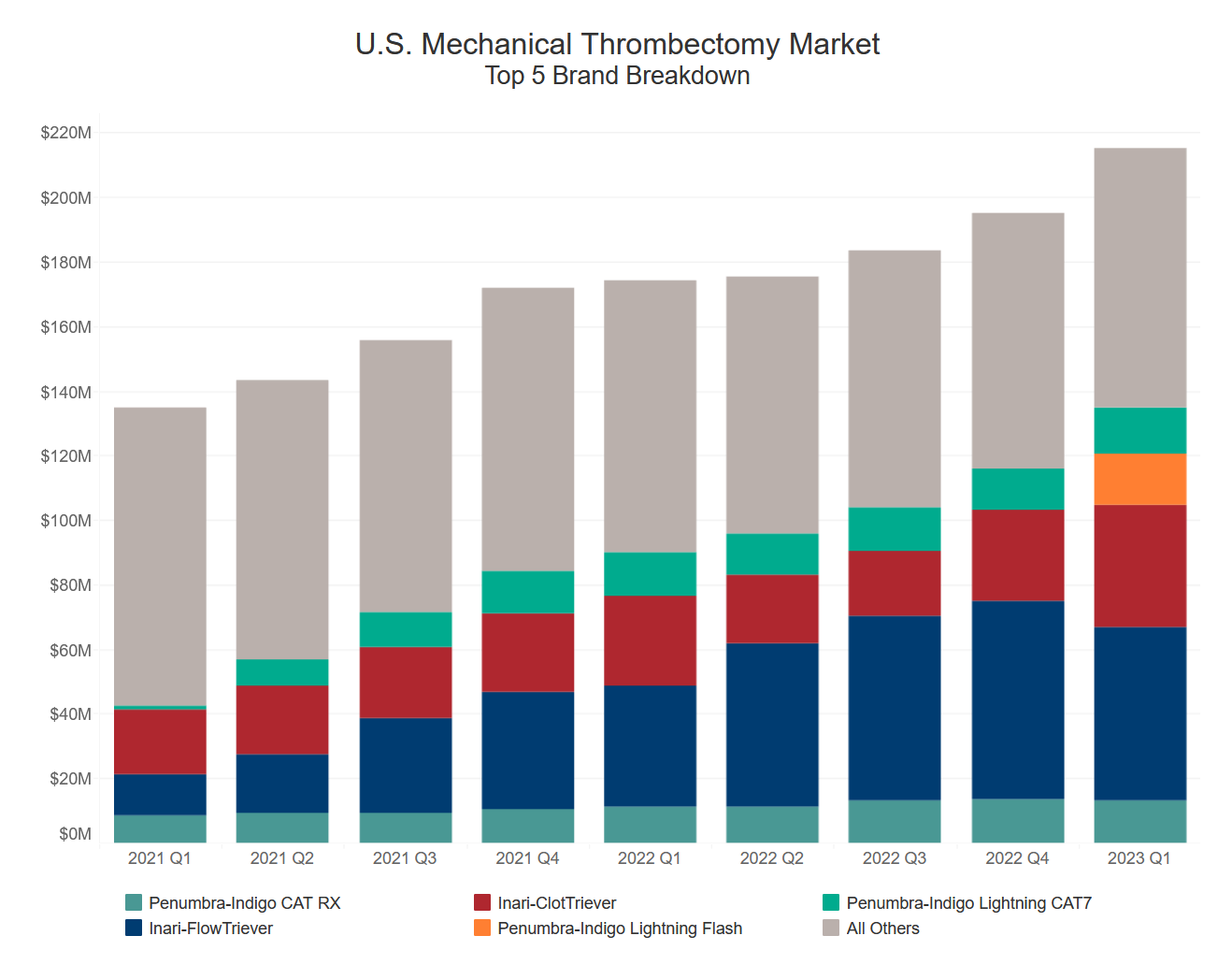

Examining the movement in market shares among these market leaders further at the brand level, we noted:

- In January 2023, Penumbra introduced Lightning Flash, a mechanical thrombectomy system that uses both pressure and flow-based algorithms to detect blood clots and blood flow.

- Lightning Flash contributed nearly $15M in sales in Q1, just after its launch, making a significant mark on the vascular thrombectomy market.

- With the recent launch of Lightning Bolt and the upcoming arrival of Thunderbolt, can Penumbra’s establish itself as the dominant player in the peripheral thrombectomy space?

The above is based on Qsight’s healthcare facilities purchasing dataset analyzing over $200M in annual spend from the dominant players in the U.S. peripheral thrombectomy market across a panel of over 700 distinct healthcare facilities and hospitals.

Post Created by Shimul Sheth, VP of Quantitative Research, Qsight