Key Takeaways

- Professional-grade skincare is becoming a core wellness behavior, driving steady, standalone revenue as consumers integrate clinical-strength products into daily routines.

- Qsight data shows rapid adoption across medspas and dermatology clinics, with younger generations fueling demand for preventative, regimen-based skincare.

- Qsight’s transactional and basket data enables brands to pinpoint purchasing patterns, optimize product positioning, and identify gaps for innovation.

In 2025, wellness is one of the primary drivers of how consumers engage with aesthetics. As holistic health routines expand to include everything from longevity supplements to injectables, skincare has emerged as a foundational behavior—a daily ritual that bridges self-care and clinical outcomes.

Aesthetics brands should take note: this growing interest in professional-grade skincare is quickly solidifying into a market trend. It now represents a measurable shift in how consumers interact with aesthetics—and a strategic opening to increase market share, improve lifecycle performance, and align product strategy with real-world behavior.

Skincare’s Position in the 2025 Aesthetics Market

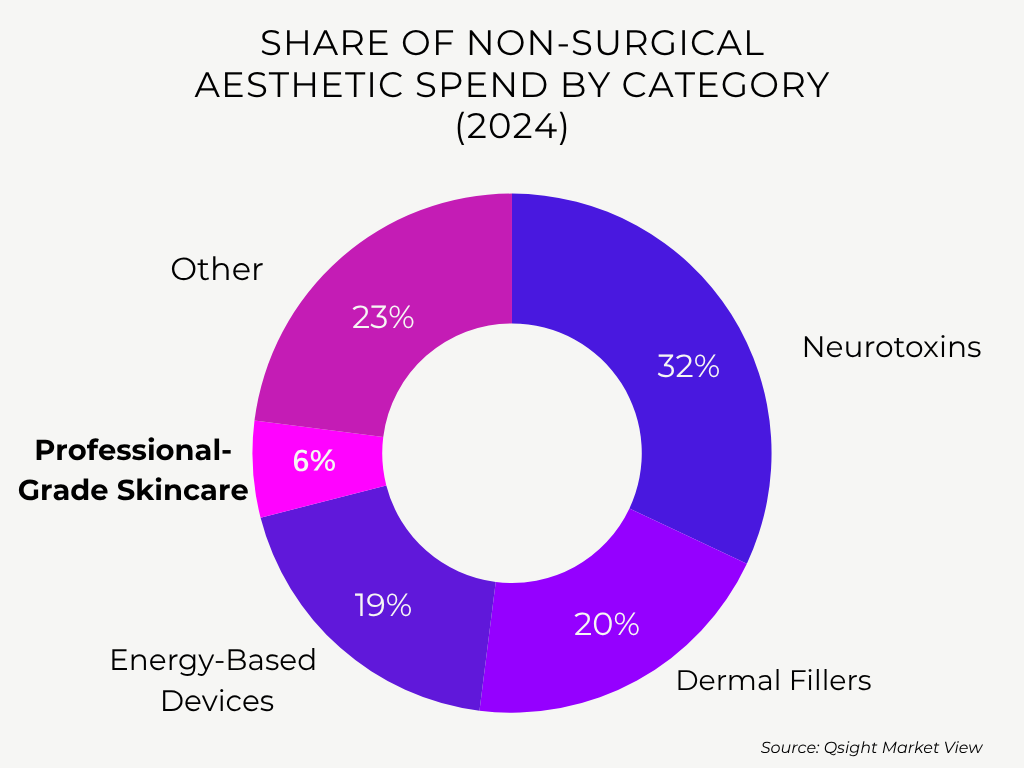

According to Qsight data, professional-grade skincare made up 6% of total non-surgical aesthetics spending in 2024, with an average spend of $313 per consumer. While it generates less revenue per procedure than injectables or energy-based devices, its visit structure makes it especially valuable: 53% of skincare visits were for skincare purchases alone, not tied to an in-office treatment.

Adoption of professional-grade skincare at the provider level has grown alongside consumer demand. Qsight data shows that in 2025, 85% of all medspas offer professional-grade skincare, up from 78% in 2017.

This widespread availability signals that skincare functions as a standalone revenue stream, driving independent traffic that doesn’t rely on procedural upsells. For many practices, it’s an accessible way to maintain continuity with consumers between visits.

Med Spas & Dermatology Clinics Are Making the Most of The Skincare Shift

While not all skincare is bundled with services, clinics that offer skin resurfacing or microneedling often stock regenerative skincare products that align with post-treatment protocols. These combinations can contribute to higher average spend per visit and reinforce adherence to longer-term treatment plans.

Together, these dynamics position skincare as both a reliable revenue driver and a strategic link to broader treatment adoption. Brands that understand this behavior are better equipped to capitalize on it.

Skincare and the Modern Wellness Routine

As consumers increasingly prioritize wellness, skincare is becoming a daily ritual rather than a reactive purchase. This shift is especially visible among Millennials and Gen Z, whose approach to aesthetics is defined by consistency, prevention, and ingredient transparency. For these segments, professional-grade skincare is part of a broader commitment to long-term health and appearance.

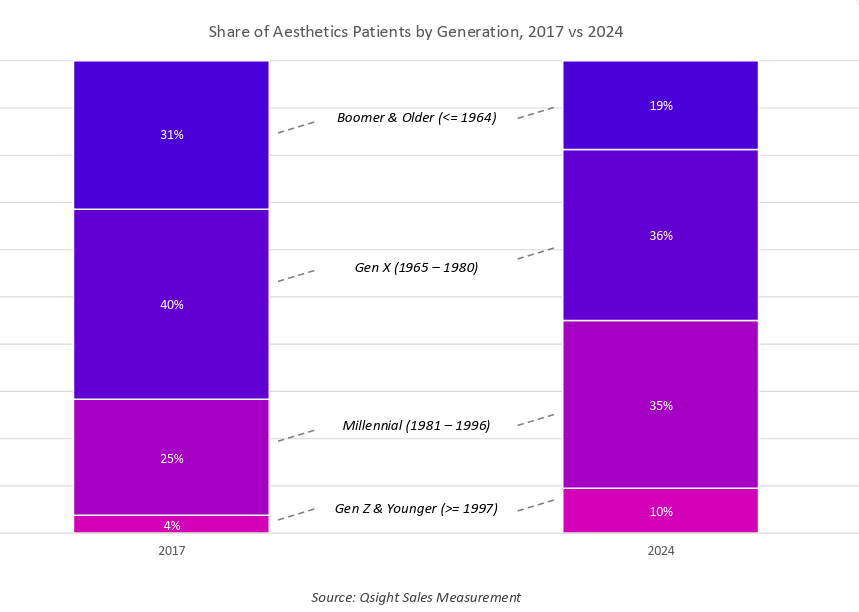

Qsight data shows a clear generational shift: Gen Z’s share of aesthetics patients has more than doubled since 2017, while Millennials are now nearly tied with Gen X for the largest share of spend. To build earlier, longer, and more meaningful relationships with consumers, brands should look for ways to tap into this demographic’s hunger for clinical-strength beauty solutions.

What begins as a daily skincare routine could become a doorway to lifetime engagement and loyalty. Only time—and data—will tell.

What the Data Can Reveal About Skincare Behavior

Understanding what’s selling is only the starting point. Qsight’s Sales Measurement solution captures transaction-level data across thousands of aesthetic practices. This gives brands visibility into how professional-grade skincare is actually being purchased—and by whom.

Core Skincare Buying Behaviors

Dashboards track:

- Unit sales and pricing trends by SKU, brand, and product type: Understand which SKUs are scaling within specific consumer segments.

- Repeat purchase behavior across age cohorts: Refine product positioning based on how often different generations repurchase and engage with skincare.

- Basket composition, showing how often skincare products are bought with or without services: Measure where and how a product fits into broader care routines.

Strategy Inputs from the Broader Qsight Suite

When combined with the full Qsight product suite, Sales Measurement becomes a powerful piece of an overall go-to-market strategy. Here are just a few ways brands can deepen their insights with additional tools:

- Qsight Prospector equips your field teams with precise, practice-level insights, enabling smarter lead targeting, faster territory planning, and more productive sales conversations.

- Qsight Market View gives you visibility into your brand’s position in the broader aesthetics landscape—tracking total market size, segment share shifts, and where your competitors are gaining or losing ground.

In a highly competitive market, data like this is essential for making decisions that move beyond assumptions and into scalable strategy.

Turning Skincare Data Into Strategic Advantage

For skincare manufacturers, practice-level data offers critical visibility into product adoption, consumer behavior, and commercial performance. But without transactional data, attempts to understand what’s working and why can be fragmented and reactive.

Qsight’s Sales Measurement platform provides the context needed to:

- Pinpoint which SKUs are growing by practice type, region, and consumer demographic

- Align pricing and promotional strategy with real spend patterns

- Track regimen completion and repeat behavior to support long-term usage

- Identify whitespace for new product development based on gaps in purchase behavior

With this level of granularity, skincare companies can sharpen their positioning, prioritize key accounts, and more confidently forecast performance across channels.

Key Takeaway: The Brands That Win Will See the Full Picture

Professional-grade skincare is fast becoming a core part of how consumers define their wellness routines and how revenue is generated across the aesthetics landscape. Brands have a unique opportunity to meet that demand with clinical credibility and proven results.

But to capture it, they’ll need more than great products alone. In a category defined by trust and results, success will depend on seeing the full picture: who’s buying, how often, at what price, and in what context.

Growth depends on more than market intuition. It depends on clarity.

Request a Demo and See How Your Brand Measures Up

Qsight’s transactional data can help skincare manufacturers build stronger relationships, increase share of wallet, and outperform category benchmarks. Request a demo of Qsight Sales Measurement to see how your portfolio performs at the practice level—and where your next opportunity lies.