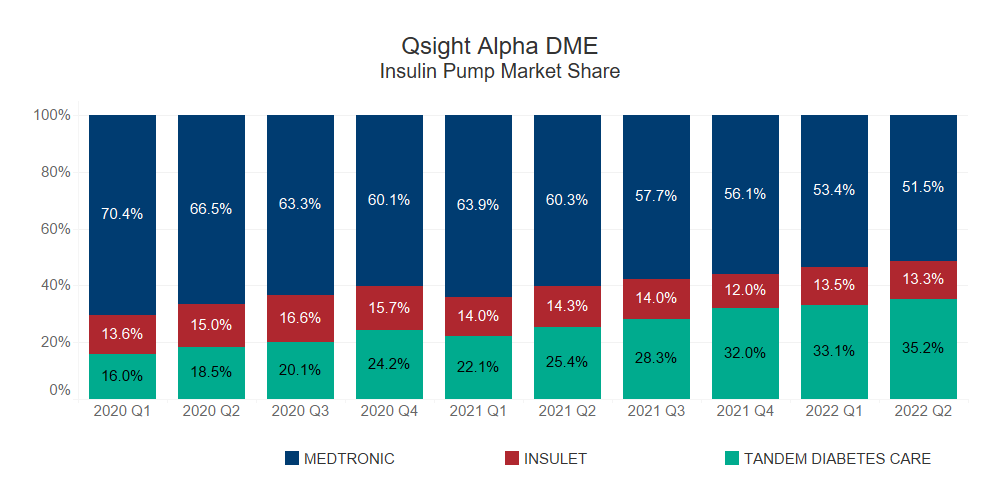

Qsight’s HME/DME Purchasing Data provides clients with real-time intelligence into market share and purchasing insights in the non-acute medical device sector. We looked at our capture of insulin pumps from the top players to assess market share and market growth in the durable medical equipment channel.

- Although Medtronic is the leader in the insulin pump market within the DME channel, Tandem Diabetes Care and Insulet are steadily gaining ground, having a combined market share of nearly 50% in 2022 Q2.

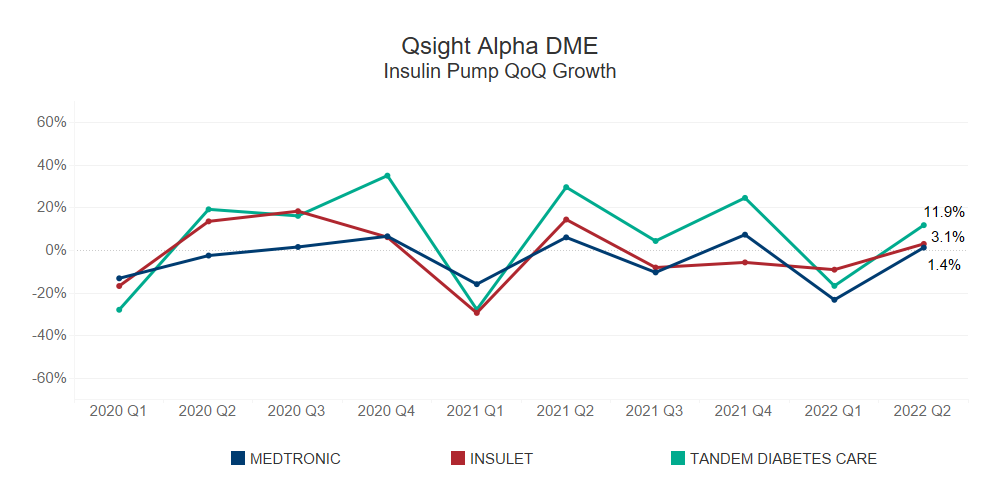

- Medtronic’s Class I recall of their MiniMed 600 series insulin pumps paved the way for Tandem and Insulet to further penetrate the market at an accelerated rate.

- On August 3rd, Tandem reported a weaker than anticipated 2022 Q2, attributing the lower growth rate to macro-economic conditions. Despite this, Tandem is dominating the insulin pump market when looking at growth across all manufacturers within the DME channel.

- With Insulet’s Omnipod available in retail-only channels and Medtronic’s recent recall, the question remains if Tandem will eventually take over the DME space.

If you would like to precisely track competitive market share and more valuable real-time insights to guide your business strategy, contact [email protected].

The above is based on Qsight’s home care data set, analyzing over $2.3B per year in medical equipment, devices, and supplies purchased by over 5,000 U.S. Durable Medical Equipment (DME) pharmacy locations.

Post Created by: Kimberlee Ales, Senior Quantitative Analyst, Guidepoint Qsight & Shimul Sheth, VP of Quantitative Research, Guidepoint Qsight, and Kenny Dolgin Director of Quantitative Research, Guidepoint Qsight.