Guidepoint Qsight’s unique mix of quantitative healthcare facility purchasing data and qualitative commentary from our Tracker panel uncovers market share, price, and physician sentiment in the U.S. Implantable Cardiac Monitor market.

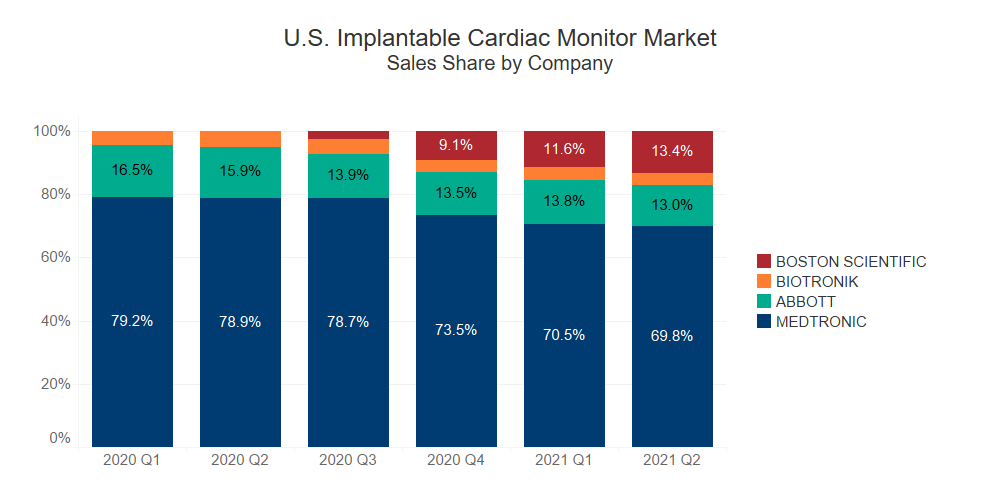

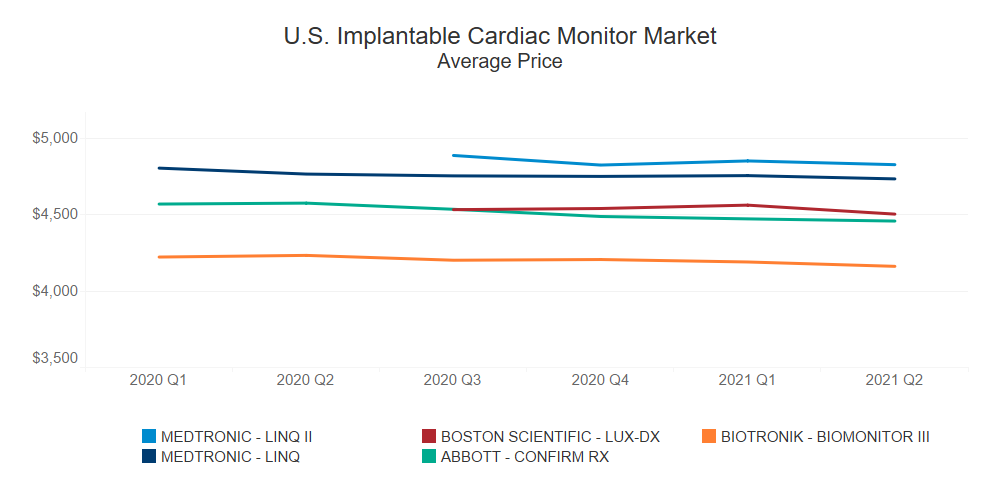

Competitively priced compared to Medtronic’s LINQ and LINQ II, Boston Scientific’s LUX-DX ICM system performed very well after its launch in August 2020, rapidly capturing ~10% of the implantable cardiac monitor market in the first quarter after its launch.

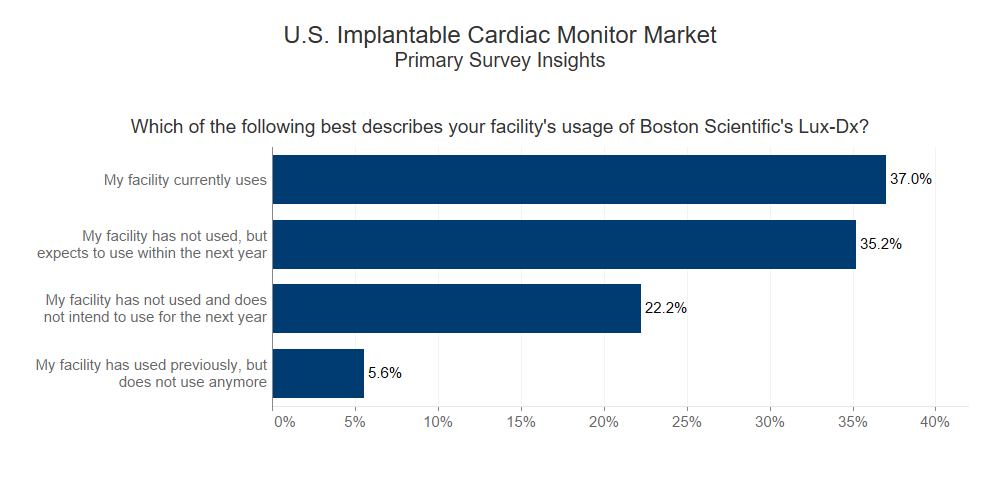

Based on commentary from our proprietary panel of cardiologists and electrophysiologists, ~72% of facilities either already use or plan to use Boston Scientific’s Lux-Dx in the next year, indicating increased adoption and a positive shift in market share.

It is still unknown how the launch of Abbott’s Jot Dx will impact Boston Scientific’s sales in the upcoming year and if it will be able to hold or increase its market share at the same rate.

The above is based on Qsight’s healthcare facilities purchasing dataset analyzing over $300M from the four dominant players in the U.S. Implantable Cardiac Monitor market across a panel of 900+ distinct healthcare facilities and hospitals. Our primary survey data is gathered from a proprietary panel of physicians from 50+ unique healthcare sites performing cardiac rhythm management procedures on a monthly longitudinal basis.

For more information, contact us to request a demo here.

Post Created by: Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight, Sean Sookhoo, Vice President of Market Research, Guidepoint Qsight, & Kenny Dolgin, Vice President of Quantitative Research, Guidepoint Qsight