Guidepoint Qsight’s healthcare facilities purchasing dataset provides insight into market share shifts in the cardiology space from 2019 to 2020.

The dataset includes interventional cardiology (cardiovascular devices, advanced circulatory support devices, heart valve repair/replacement systems), cardiac rhythm management, and electrophysiology segments.

- Edward’s Lifesciences, Abbott Labs, Medtronic, and Boston Scientific are leading competitors in the interventional cardiology space.

- The cardiac rhythm management market is dominated by Medtronic, Abbott Laboratories, and Boston Scientific.

- Electrophysiology makes up the smallest percentage of cardiology device spend share, with Johnson & Johnson as the leader in the space.

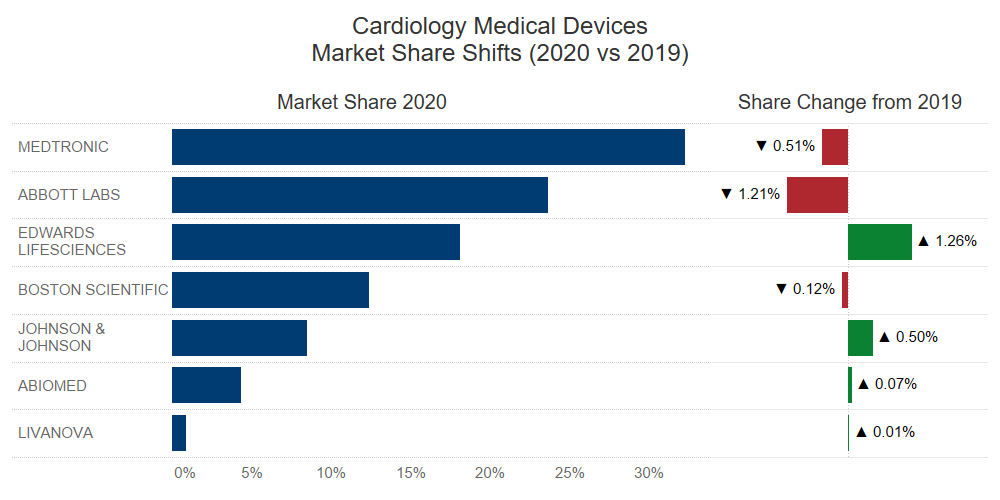

When looking at medical device purchasing trends, the top three manufacturers in the space have experienced the largest shifts in market share:

- Medtronic saw a downward shift of half a percent (0.51%) but is maintaining its place as the leader in the space with more than 30% of the overall cardiology market share.

- Competing in multiple subsegments, Abbott Laboratories saw a decline in market share (-1.21 points) from 2019 to 2020 across all subsegments.

- Edwards Lifesciences (EW), a top manufacturer in international cardiology, saw a positive shift in market share, gaining 1.26 points in market share in 2020 compared to 2019, despite a year-over-year decline of 7% in medical device purchasing in interventional cardiology.

The above is based on Qsight’s healthcare facilities purchasing dataset that analyzes over $26.2B from 14 players in medical devices across a panel of close to a thousand distinct healthcare facilities and hospitals.

Post created by: Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight