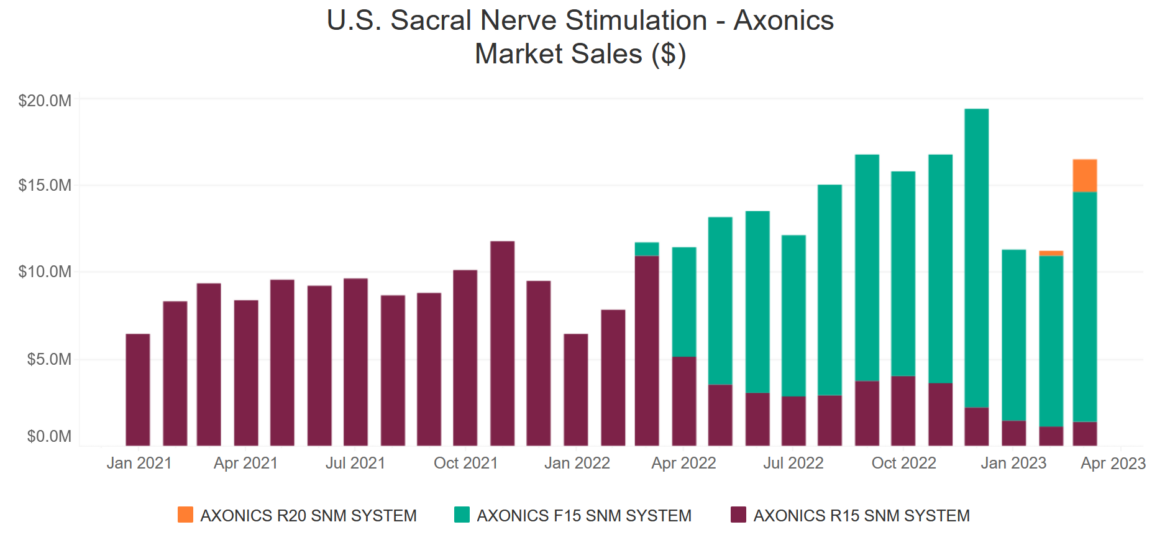

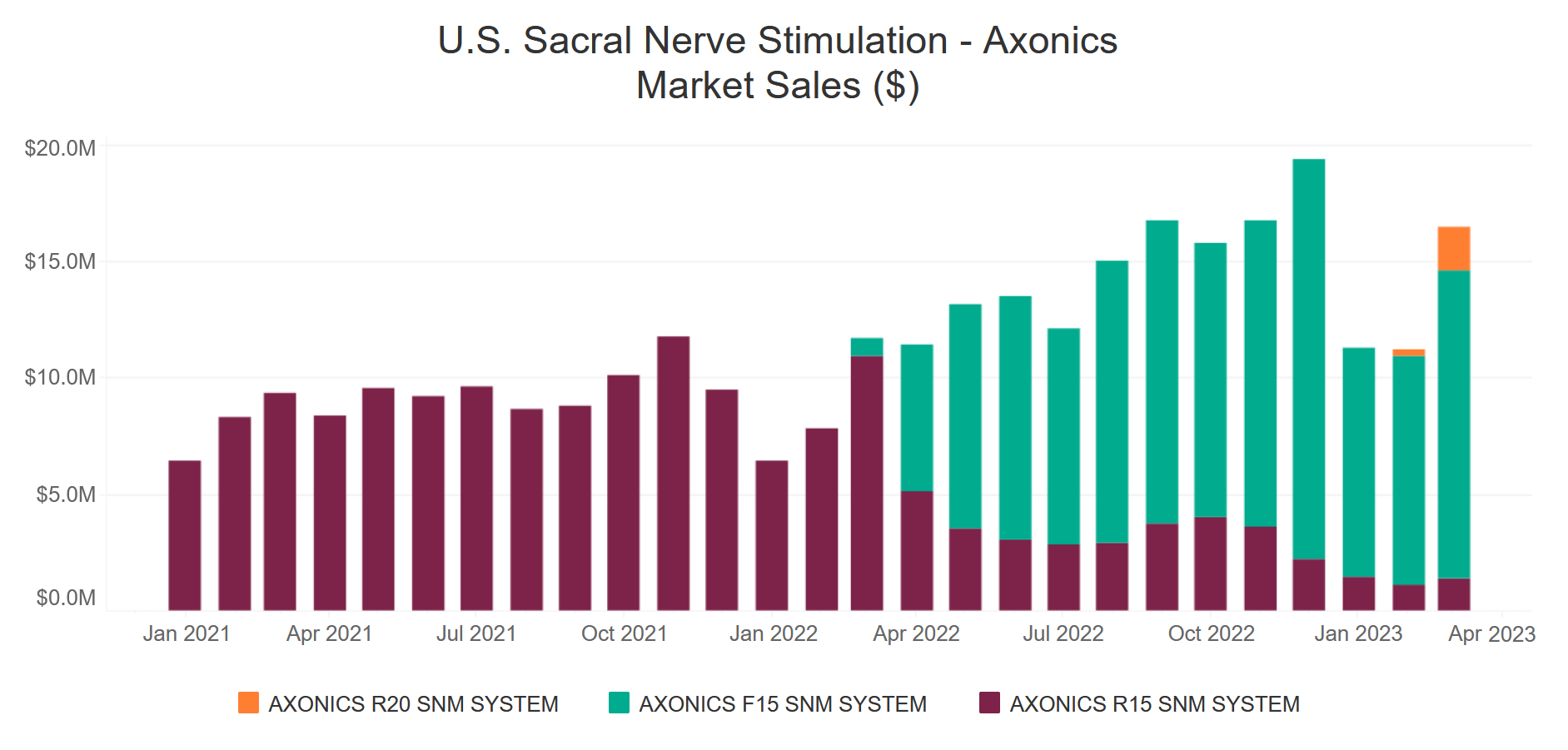

Qsight has been monitoring the Axonics F15 SNM System since its launch in March 2022. Our healthcare facilities dataset shows that Axonics experienced a rapid increase in sales after the launch of this system, as this system offers a recharge-free option that now directly competes with Medtronic’s Interstim X.

- Qsight’s healthcare facilities dataset detected Axonics F15 sales in March 2022, one month prior to the full launch in April, demonstrating early positive signals in the product.

- In April 2022, the Axonics F15 system generated nearly $7 million in sales, in just one month, making a solid impact on an already strong portfolio of products.

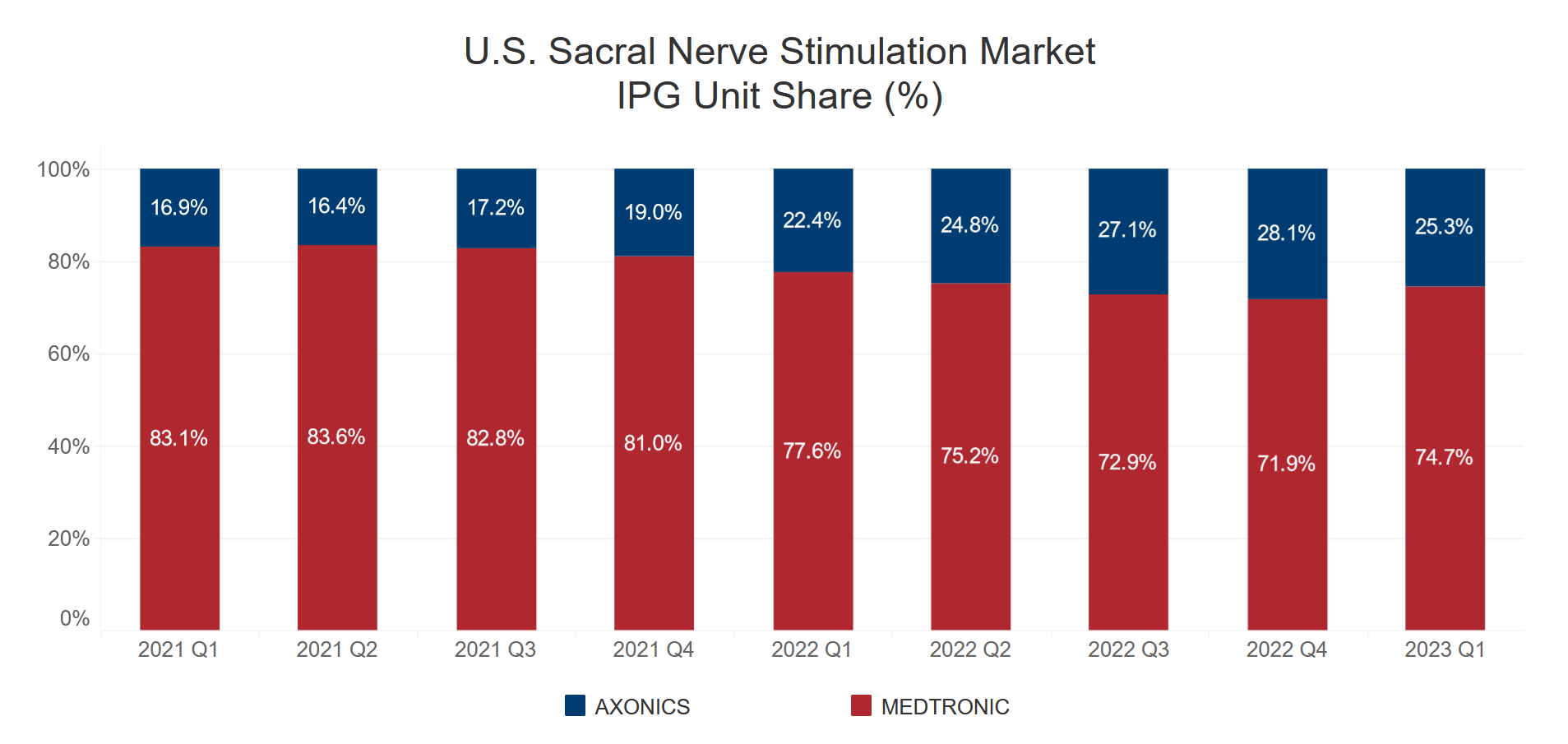

- When taking a closer look, our data shows that Axonics has been gaining share over time, only accelerated by the launch of F15, capturing more than 25% of IPG share in 2023 Q1.

- Increased usage of Axonic’s F15 paved the way for early adoption for Axonics, as it launched the R20 SNM system in Q1 2023.

- With this next-generation rechargeable system now available, the question remains if Axonics’ already steadily growing market share will continue to accelerate within the sacral nerve stimulation market.

The above is based on Qsight’s healthcare facilities purchasing dataset analyzing over $600M in annual spend from the two dominant players in the U.S. sacral nerve modulation market across a panel of over 700 distinct healthcare facilities and hospitals.

Post Created by Jesse Shyti, Senior Quantitative Analyst, Qsight