With the end of year quickly approaching, the Aesthetics team at Guidepoint Qsight reviewed several years of trending data from Qsight Aesthetics Point-of-Sale and Qsight Aesthetics Tracker to unpack how behavior changes at MedSpas and Aesthetics practices in and around the holiday season.

Qsight Aesthetics Point-of-Sale data provides near real-time tracking of patient spending in Aesthetics practices and MedSpas. Our data enables unparalleled insight into the Aesthetics market by segment and patient demographic group, including brand market share, sales growth, visits, basket composition, and more. With our powerful first-in-industry data assets, our team knows exactly what is happening at Aesthetics practices, including how patients behave leading up to the holiday season.

Qsight Aesthetics Tracker is our proprietary survey-based data collected from US Aesthetics practitioners (Dermatologists, Plastic Surgeons, and Non-Core Physicians) trending back to 2007. This proprietary dataset provides deep insight into the actions, behaviors, perspectives, and opinions coming directly from Aesthetics practitioners.

FOR THE 2023 HOLIDAY SEASON (Q4), THE AESTHETICS INDUSTRY SHOULD EXPECT:

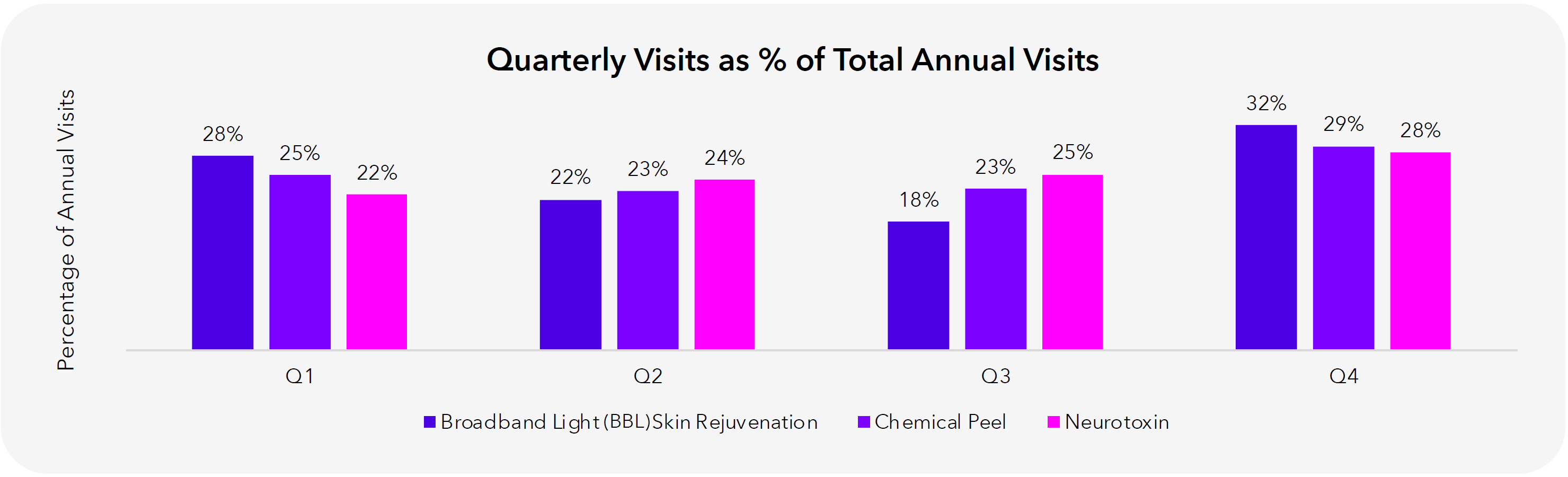

1. Peak demand for Neurotoxins, Chemical Peels, and Broadband Light (BBL) Skin Rejuvenation treatments

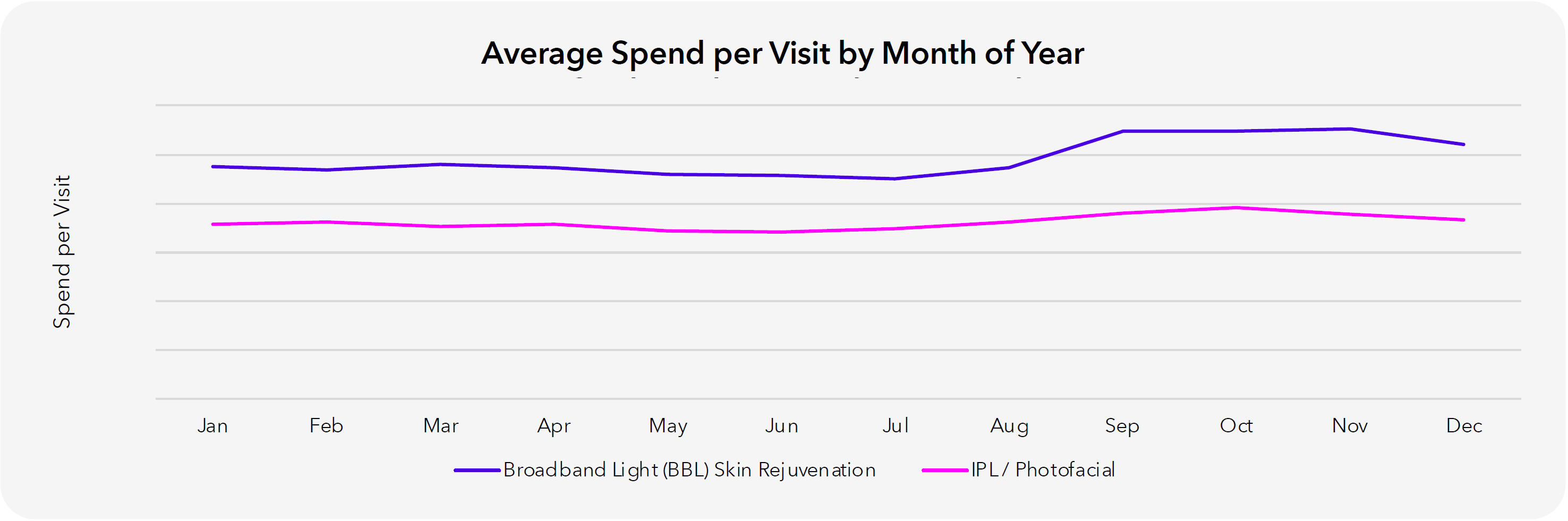

2. A rise in per-visit patient spend on light wave therapies (BBLs and IPLs)

3. Patients to visit more and spend more per visit on Professional Grade Skincare products

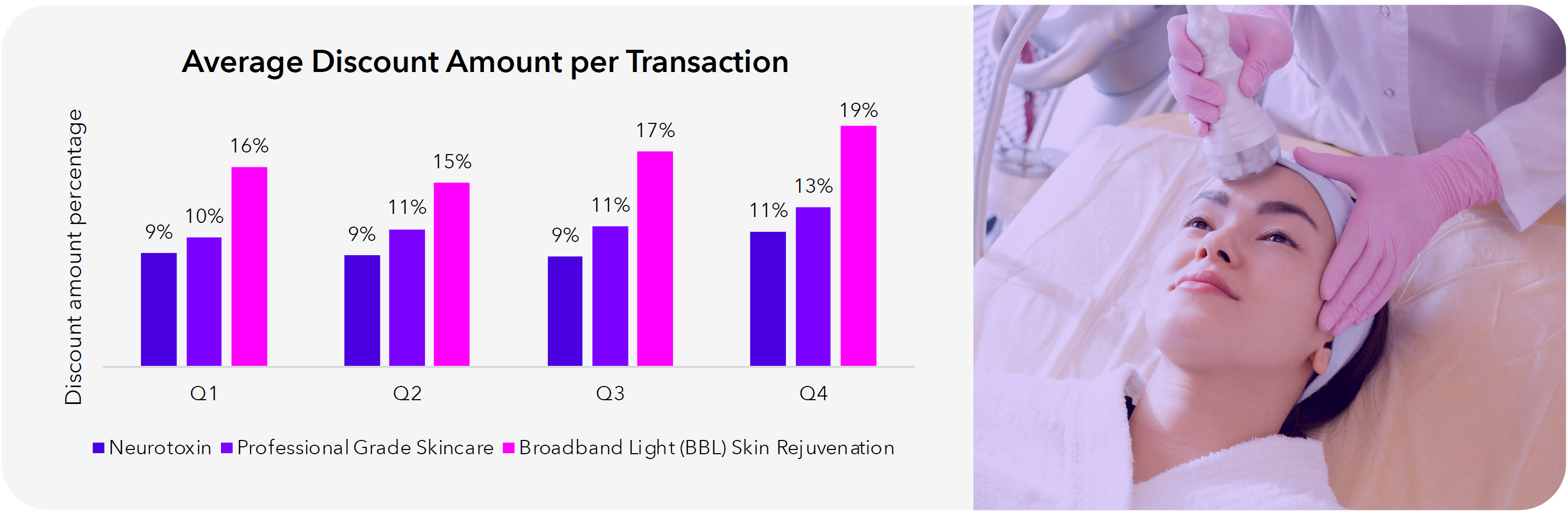

4. Greater discounting for Neurotoxins, Professional Grade Skincare, and BBL Skin Rejuvenation

5. Consistent spending patterns across patient generational (age) groups

Note:

Transaction data from the year 2020 was excluded wherever seasonality is relevant to mitigate the impact of Covid on the analyses.

1. PEAK DEMAND FOR NEUROTOXINS, CHEMICAL PEELS, AND BROADBAND LIGHT (BBL) SKIN REJUVENATION TREATMENTS

It is no surprise that people want to look their best for holiday festivities and get togethers. Neurotoxins, Chemical Peels, and Broadband Light (BBL) Skin Rejuvenation all generate their highest share of visits between October and December compared to the rest of year.

Given these trends, it is not surprising to see that Aesthetic practitioners, through Qsight Aesthetics Tracker, claim their Neurotoxin injection volumes increase in Q4, with 77% of practitioners claiming they increased injections month-over-month (MoM) in November 2022 and 60% in December 2022. Many practitioners claim this trend is driven by the end of the holiday season, people returning from vacation, and special promotions in the fourth quarter driving up visits and volumes.

In the case of Chemical Peels and BBL Skin Rejuvenation, which result in temporarily increased skin sensitivity, it makes sense that these procedures peak in the fourth quarter; patients are likely waiting for colder months when they are anticipating a decline in time outdoors to reduce sun exposure on sensitive skin.

In contrast, other treatments like Radiofrequency and Cryotherapy-based Body Contouring see volume declines between October and December, with their peak season being springtime. The months leading up to summer are a popular time for patients to seek out treatments that help them reach that enviable summer body.

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

2. A RISE IN PER-VISIT PATIENT SPEND ON LIGHT WAVE THERAPIES (BBLS AND IPLS)

When it comes to per-visit spend, patients are spending more on light wave therapies such as Broadband Light (BBL) Skin Rejuvenation and Intense Pulsed Light (IPL) therapy between October and December.

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2023 (YTD)

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2023 (YTD)

We observed that volumes per visit are a factor driving this; patients are getting more areas of their body treated during this time, resulting in a higher cost per visit for these procedures.

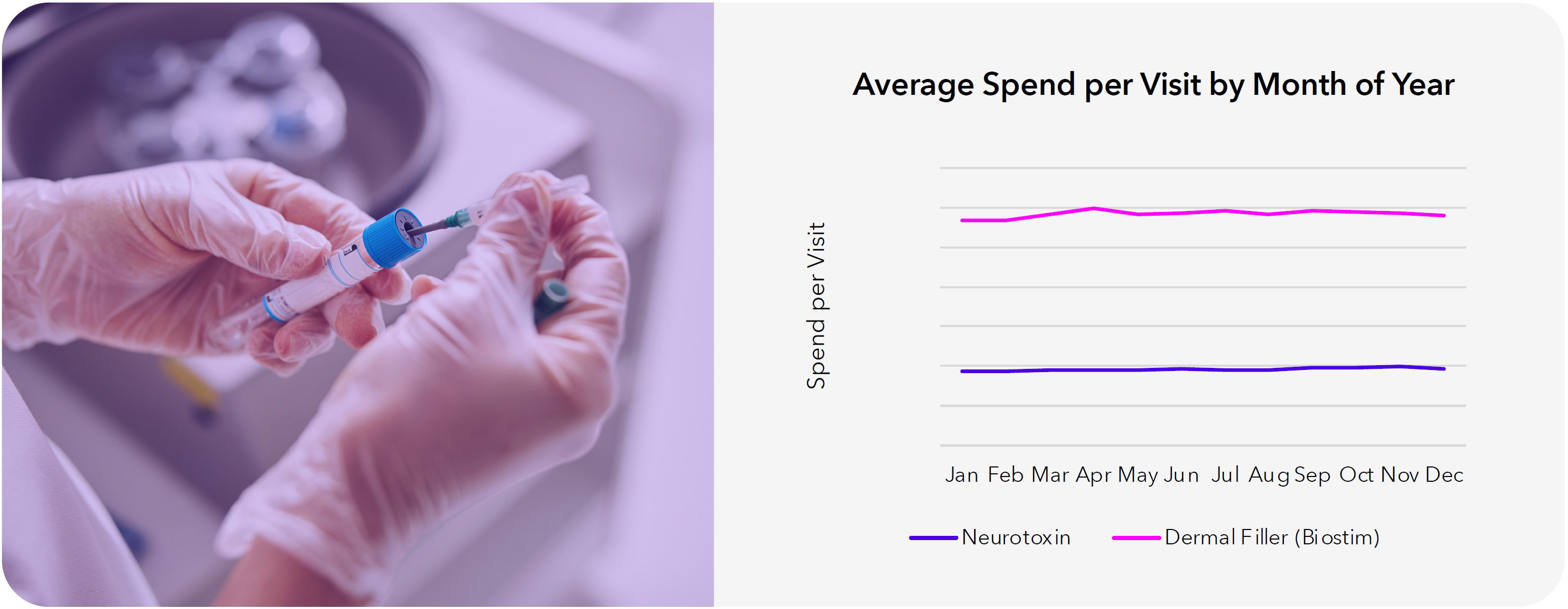

Contrast this with Neurotoxins and Dermal Filler procedures, which exhibit more stable spend per visit throughout the year (though recall that Neurotoxin visits tend to peak in the fourth quarter). Patients receiving injectables are generally on a consistent, longer-term plan that requires regular visits to maintain the benefits.

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2023 (YTD)

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2023 (YTD)

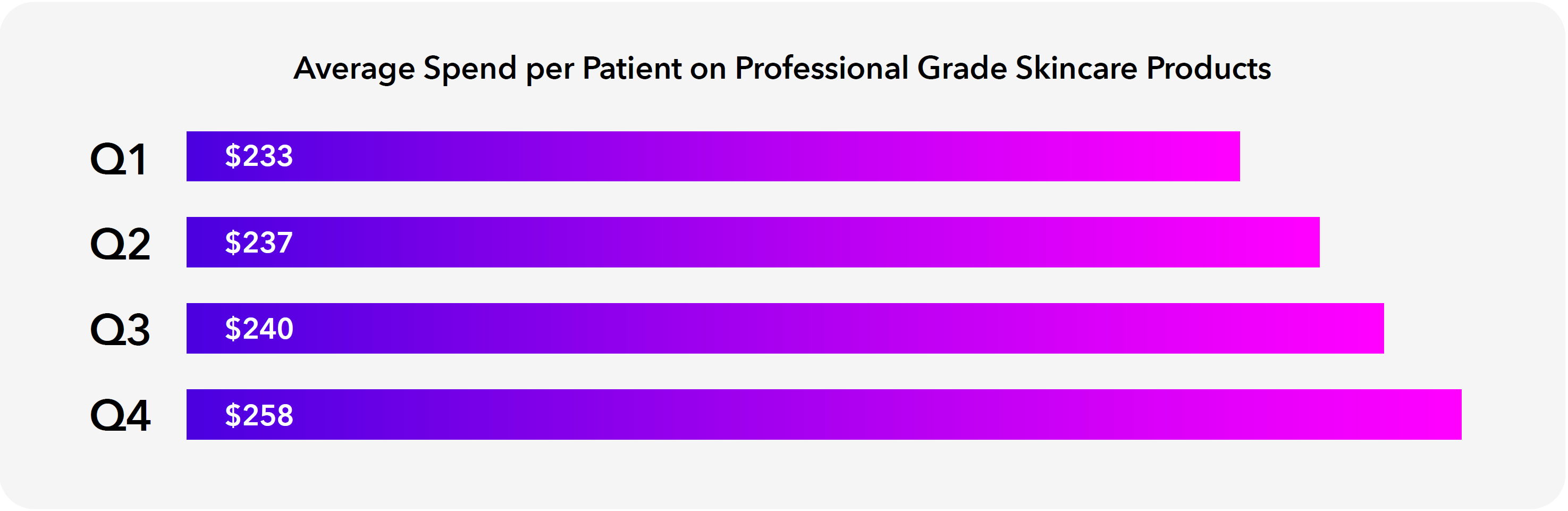

3. PATIENTS TO VISIT MORE AND SPEND MORE PER VISIT ON PROFESSIONAL GRADE SKINCARE PRODUCTS

Patients spend more on Professional Grade Skincare in MedSpas and Aesthetics practices during the holiday months.

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

As Professional Grade Skincare transactions per patient increase during this time, patients are likely visiting MedSpas for more treatments in Q4, resulting in more occasions to purchase skincare. Further, patrons may be picking up extra skincare products as gifts for loved ones during the holidays.

4. GREATER DISCOUNTING FOR NEUROTOXINS, PROFESSIONAL GRADE SKINCARE, AND BBL SKIN REJUVENATION

During the fourth quarter, we observe heavier discounting when it comes to Neurotoxin injections, Professional Grade Skincare products, and BBL Skin Rejuvenation.

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2023 (YTD)

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2023 (YTD)

When surveyed about promotional activity during the holiday months, more than half of Qsight Aesthetics Tracker practitioners claim that promotional efforts in the holiday months contributed to sales of Neurotoxin injections around that time. Practices are taking advantage of timeliness and increased interest for aesthetic procedures during the holiday months and brand-led discounting and promotions.

5. CONSISTENT SPENDING PATTERNS ACROSS PATIENT GENERATIONAL (AGE) GROUPS

As analysts, we love uncovering interesting changes versus the average or the norm. However, an insight can be just as powerful if there is no change. With that, our final observation is that the contribution to visits and spend by generation group in Q4 does not differ significantly from the rest of the year. Digging in further, we also see that the share of treatments and procedures by generational group does not vary significantly in the fourth quarter versus the rest of the year.

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

Qsight Point-of-Sale: Qsight’s real-time point of sale (POS) dataset tracking patient spending in Aesthetics Practices, transaction data inclusive of years 2017 to 2022

WITH ACCESS TO GUIDEPOINT QSIGHT AESTHETICS DATA SOLUTIONS, YOU CAN TAKE ACTION.

By fully understanding market trends and patient behavior within the Aesthetics industry, companies can enhance their ability to strategize for seasonal demand and requirements. With Qsight Aesthetics Point-of-Sale and Qsight Aesthetics Tracker, you can gain the insight and assurance required to proactively prepare and respond.

Book a demo today: qsight.guidepoint.com/#demoForm