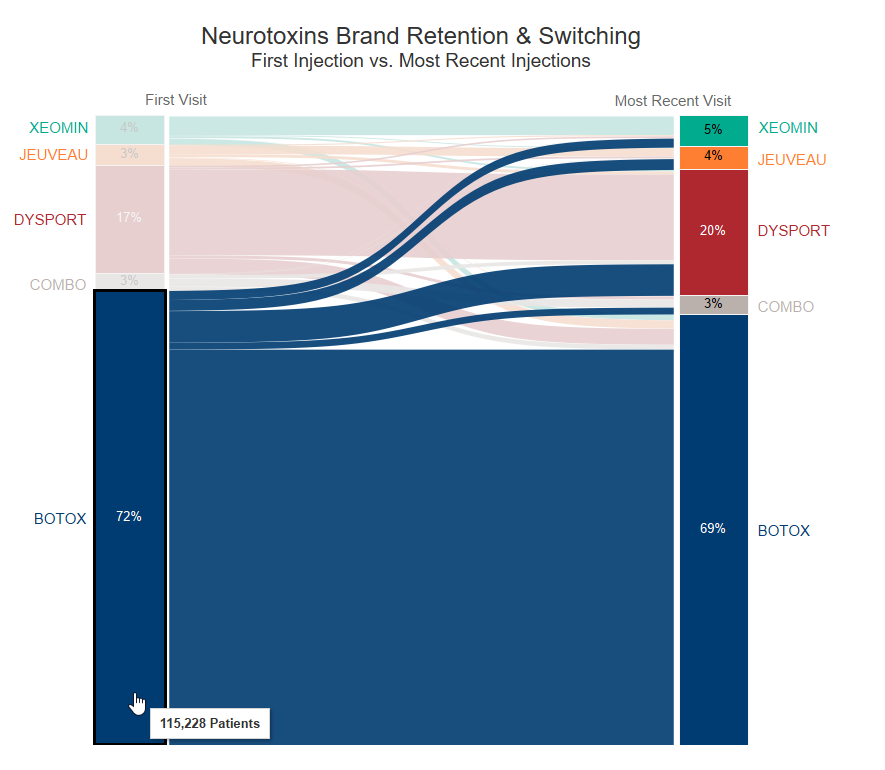

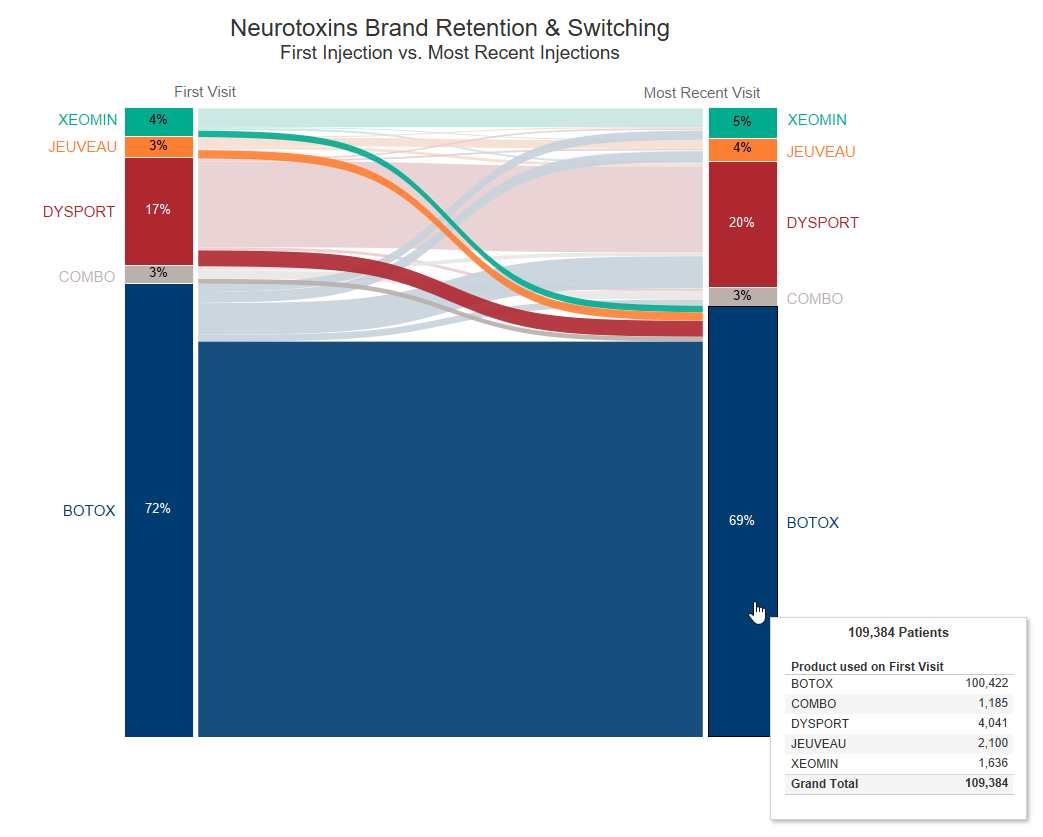

Guidepoint Qsight’s proprietary Aesthetics data examines patient spending in the United States, providing insight into brand retention in the Neurotoxin space.

Using a sample of patients who had at least three Neurotoxin injection visits over at least six months (n=159,657), we reviewed what brand they started on (first visit) and which brand they used in their most recent visit.

- Botox is the most common starting brand, used by 72% of first-time Neurotoxin patients.

- Our data shows that Botox has a larger market share on the first visit (72%) than most recent (69%), indicating that more patients are switching from Botox to another product than switching to Botox.

- 13% of patients who started on Botox switched to a different brand in their most recent visit.

- 8% of patients who had Botox done their most recent visit started with a different brand.

- While Botox lost about 4% in total share based on the most recent visit brand, Dysport gained 3% share (17% vs. 20%), and the majority of the increase in Dysport share came from Botox starters.

- Despite losing some brand share, Botox still has the highest retention rate between first and most recent injection: 87% of patients who started on Botox also used Botox in their most recent visit.

These findings come from Qsight Aesthetics point-of-sale data from 1,385 aesthetic facilities across the United States with patient visits from May 2019 to September 2021. The patient sample (n=159,657) is Neurotoxin patients who had at least three Neurotoxin injection visits over six months or more.

For more information about Qsight Aesthetics data, contact us here.

Post Created By Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight