Guidepoint Qsight’s medical device market-level dataset has captured trends in multiple MedTech market segments.

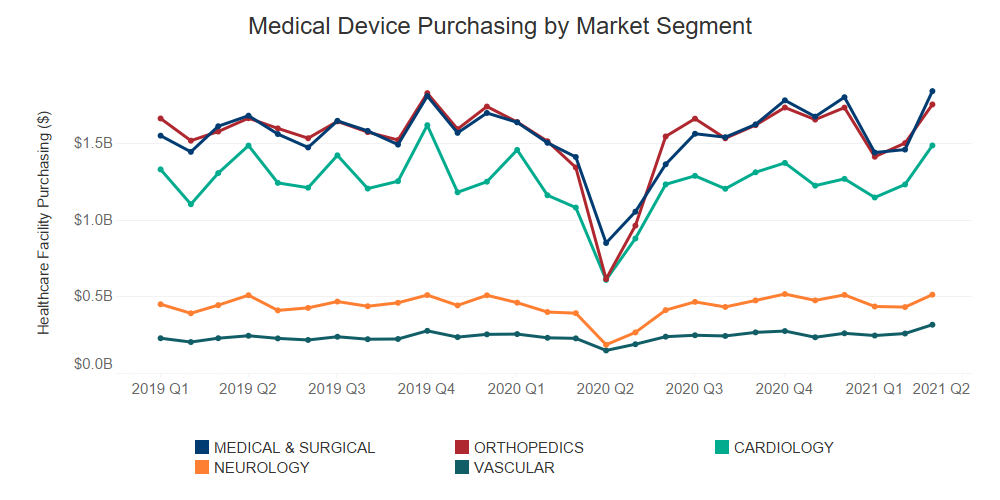

- Following the sharp drop at the beginning of the COVID-19 pandemic, U.S. medical device purchasing spend rebounded quickly in July 2020 back to pre-COVID-19 levels for all five market segments captured in our dataset.

- Segments most subject to elective procedures experienced the biggest downfall, not only in April 2020 but also in January 2021, due to increased COVID-19 cases.

- Based on commentary from our proprietary panel of physicians, the easing of COVID-19 restrictions, increased vaccination rates, and working through backlogged procedures are all potential reasons for the bounce back in March 2021.

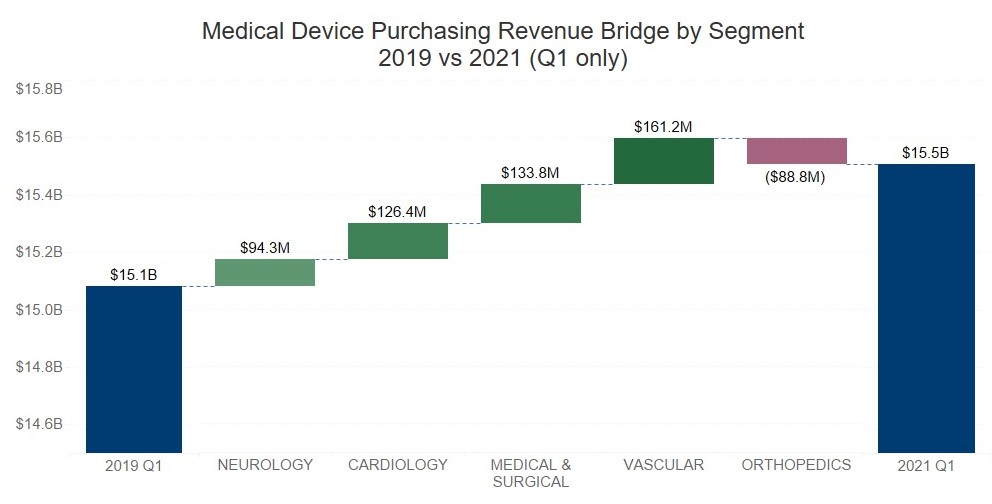

- When looking at growth for each segment between 2019 Q1 and 2021 Q1, our healthcare facilities purchasing dataset reflects an increase of 2.6% ($15.1B to $15.5B), signaling towards market recovery.

- All segments showed an increase in revenue from 2019 to 2021, except Orthopedics, likely due to the elective nature of their procedures, January holidays, increased COVID-19 infections, and inclement weather delaying procedures.

The above is based on Qsight’s healthcare facilities purchasing dataset analyzing over $20B in annual spend from the top 25 players in medical devices across a panel of 2200+ distinct healthcare facilities and hospitals.

Post Created by: Shimul Sheth, Senior Quantitative Analyst, Guidepoint Qsight & Rain Li, Data Science Intern