As 2023 began with lingering economic concerns from 2022 (inflation, rising interest rates, risk of recession, etc.), the aesthetics industry’s hope for continued strong growth may be challenged. A declining economic climate often dampens consumer spending on expensive aesthetics procedures while the sales of relatively affordable cosmetics, such as lipsticks, tend to increase – a phenomenon popularly known as the “Lipstick Effect.”

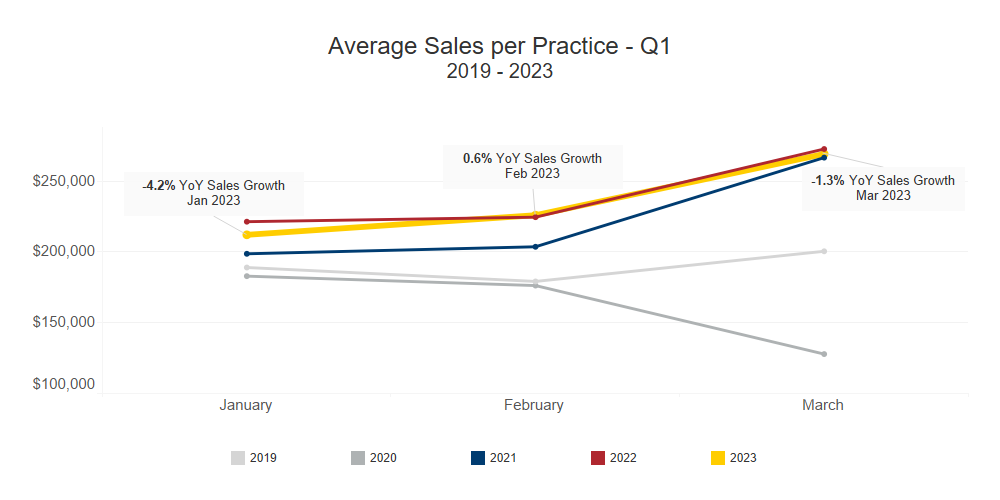

Upon the conclusion of the first quarter of 2023, Qsight did an analysis of our proprietary aesthetics point-of-sale data to gain insight into sales trends of an average U.S. aesthetics practice and to investigate the performance of various treatment categories. Overall, our data indicate lackluster growth in year-over-year practice-level sales. While markedly stronger than pre-COVID levels, trends are slightly down when compared to the same periods in 2022.

- Our data shows the expected seasonal uptick in March, but relatively in line with recent years on a year-to-year basis.

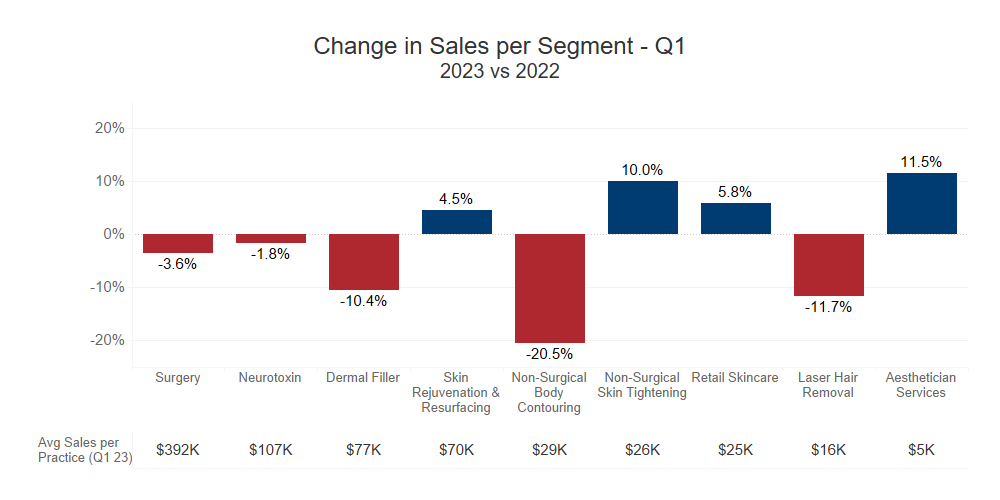

Looking deeper, we drilled down to specific treatment categories to analyze dynamics at a more granular level.

- Skin Rejuvenation and Resurfacing, Non-Surgical Skin Tightening, Retail Skincare, Aesthetician Services: These treatment categories all saw year-over-year growth in patient spend per practice in Q1 2023 as compared to Q1 2022 (+4.5%, +10.0%, +5.8%, +11.5% respectively).

- Surgery (or surgical procedures), Neurotoxin, Dermal Filler, Non-Surgical Body Contouring, Laser Hair Removal: Our data shows that patient spend within these treatment categories are down 2023 Q1 as compared to last year. (-3.6%, -1.8%, -10.4%, 20.5%, -11.7%, respectively).

Further in-depth analysis of Qsight’s aesthetics point-of-sale data can provide insight into these trends down to the brand-level to uncover competitive dynamics. Aesthetics Manufacturers of treatments are in a fierce fight for a share of the aesthetics pie. However, if these trends continue into the remainder of 2023 and beyond, the growth of that pie may not live up to the hopes of the industry.

For a more detailed view into our aesthetics dashboard showcasing industry level trends, contact us here contact [email protected].

The above analysis is based on Qsight’s medical aesthetics industry dashboard that analyzes billions of dollars in sales from millions of transactions across hundreds of MedSpas and physician practices in the United States.

Post Created by Gaurav Sharma, Senior Director, Guidepoint Qsight, Erik Haines, Managing Director, Guidepoint Qsight, and Shimul Sheth, VP of Quantitative Research, Guidepoint Qsight