Key Takeaways

- Gen Z is accelerating the shift toward preventive aesthetics, engaging earlier and treating injectables and skincare as core elements of long-term wellness.

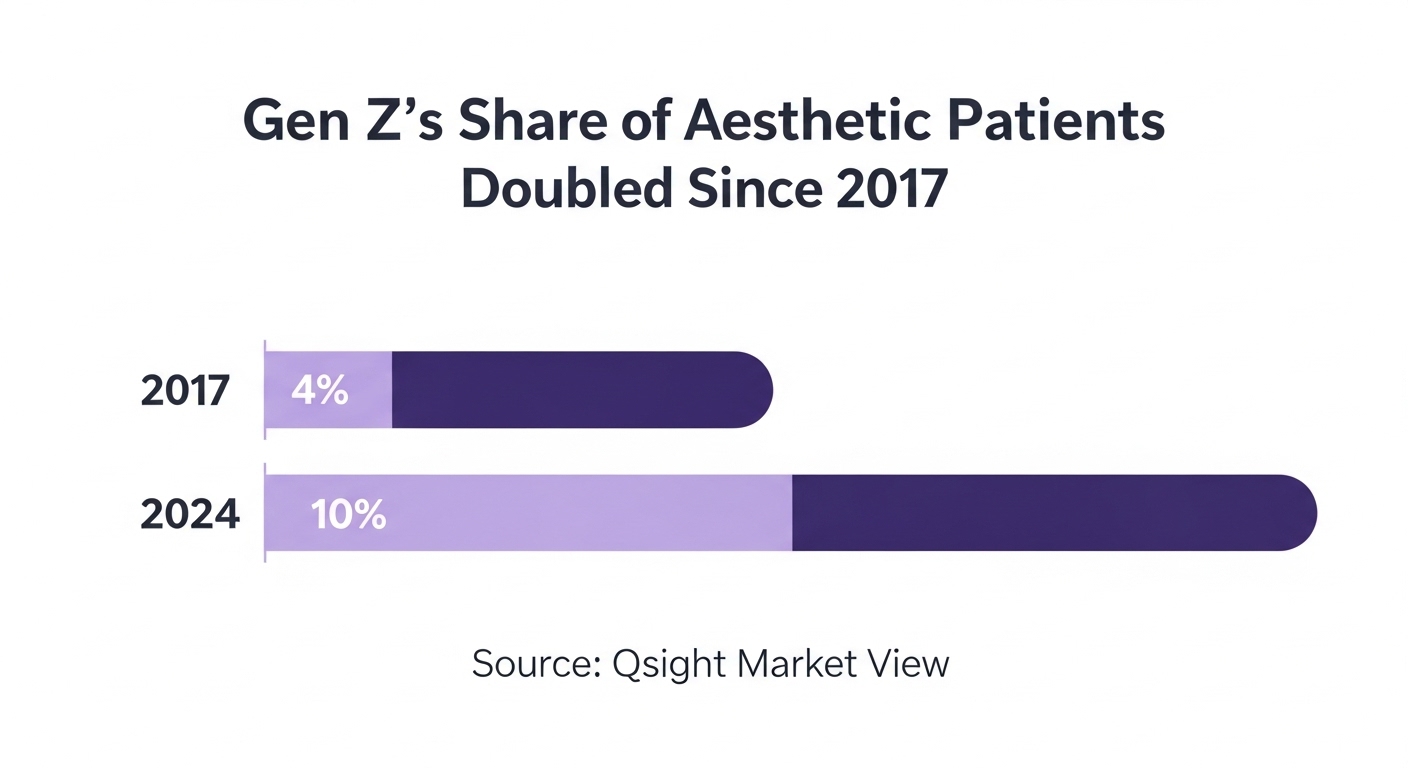

- Gen Z’s share of the market grew from 4% to 10% since 2017, with strong uptake in neurotoxins, skincare, and laser resurfacing.

- Brands must use granular, cohort-based data to tailor products, mix, and messaging to Gen Z’s preferences for continuity and confidence over correction.

Gen Z is leading a generational shift in the medical aesthetics market. For this rising cohort, preventive aesthetic treatments are a key part of how they define wellness. That means procedures like injectables and laser resurfacing aren’t exclusively about reversing aging anymore.

Once viewed as luxury splurges for middle-aged consumers, aesthetic treatments are increasingly being seen as routine self-care by younger generations. This marks a major departure from the traditional lifecycle of aesthetic medicine.

Here, we’ll take a closer look at this shift and what it means for aesthetic brands and manufacturers.

Prejuvenation Replaces Restoration

In years past, patients typically entered the aesthetic world in their 40s or later, often with a specific concern to correct. Gen Z is flipping that script. They’re stepping in earlier, not because something’s wrong, but because they want to maintain—or even optimize—what they already have.

This philosophy, often described as prejuvenation, is driving real behavior change. Consumers in their 20s are booking appointments for neurotoxins like Botox®, investing in skincare, and asking about resurfacing options as preventive choices tied to their sense of long-term health.

While “wellness” has definitions ranging from better sleep to more mindfulness, for Gen Z, “better appearance” is a top-three wellness concern.

Real-Time Data Shows Generational Growth in the Aesthetics Market

Qsight data shows that in 2017, Gen Z made up just 4% of all aesthetics patients. By 2024, their share had grown to 10%. This growth signals not only a demographic aging into eligibility but also early engagement with aesthetics across multiple non-surgical categories, including neurotoxins and professional-grade skincare.

Preventive Botox Is No Longer Niche

One of the clearest signs of Gen Z’s mindset around aesthetics is their early and intentional use of neurotoxins as part of a long-term care strategy.

Qsight Sales Measurement data shows that in 2025, neurotoxin treatments made up 20% of Gen Z’s total non-surgical aesthetic spend, up from 12% in 2021. That level of growth reflects a generational realignment in when and why patients begin aesthetic treatments.

For brands and practices, this creates an opportunity to meet early-stage patients with education, appropriately scaled treatment plans, and messaging that emphasizes continuity and confidence rather than correction.

Skincare as the Starting Line

Qsight Sales Measurement data shows that Gen Z patients are contributing to steady growth in professional-grade skincare. While GLP-1s, neurotoxins, and energy-based treatments are currently capturing more attention in the aesthetics conversation, skincare remains a consistent and viable entry point for many.

For companies operating in the skincare space, segment-specific tracking offers ways to continue capitalizing on the steady footprint of clinical solutions. Qsight’s basket analysis and patient demographic data allow brands to track how these categories interact across age groups and spending patterns. This shows not only what’s selling but also who’s buying it and how that aligns with overall treatment behavior.

Understanding the Gen Z Patient Lifecycle

The combination of early engagement with neurotoxins and skincare suggests new lifecycle dynamics. Qsight tools give brands and providers the visibility to monitor emerging patterns across patient age groups.

With Qsight, brands can track:

- Treatment frequency by cohort

- Product bundling trends across service lines

- Shifts in average spend per visit for younger cohorts

- Changes in patient acquisition across medspas and physician practices

These insights help teams anticipate where Gen Z is headed—and how to stay ahead of it.

Strategic Considerations for Brands and Providers

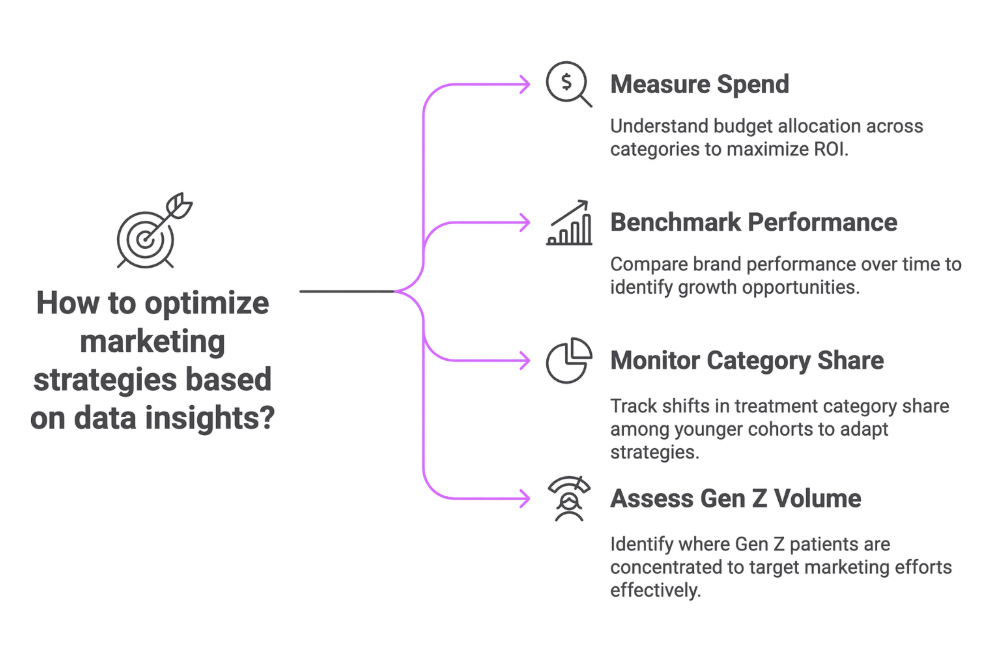

Qsight’s tools allow teams to move from anecdotal decision-making to data-driven strategy. With this product suite, companies can:

- Measure spend by patient age across neurotoxins, skincare, and other key categories

- Benchmark brand performance at the segment level over time

- Monitor shifts in treatment category share among younger cohorts

- Assess where Gen Z patient volume is concentrated across medspas and physician practices

Understanding these patterns is critical for planning. Companies aiming to engage younger patients can use this data to guide decisions around:

- Product mix optimization by practice channel

- Brand share performance in Gen Z–dense markets

- Generational trends in category growth

Qsight’s ability to isolate spend by age cohort, alongside pricing, practice type, and procedure data, gives brands a more accurate picture of where, and with whom, momentum is building.

Looking Ahead: The Gen Z Standard

Gen Z isn’t retracing Millennial footsteps. They’re taking a different path: one that’s earlier, more integrated, and deeply intentional. They’re not hesitant about injectables or medical skincare. What’s more, they’re informed, proactive, and investing in aesthetic care as part of a broader commitment to wellness.

With that comes a new set of expectations: how treatments are framed, how services are delivered, and how brands communicate. The future of medical aesthetics belongs to those who understand the people shaping demand. Right now, that’s Gen Z. And the opportunity to meet them with precision is here.

Request a Demo

Want to track how Gen Z is spending by treatment, brand, and visit? Explore how Qsight’s real-time data tools can help your team plan with confidence. Request a demo today to get started.