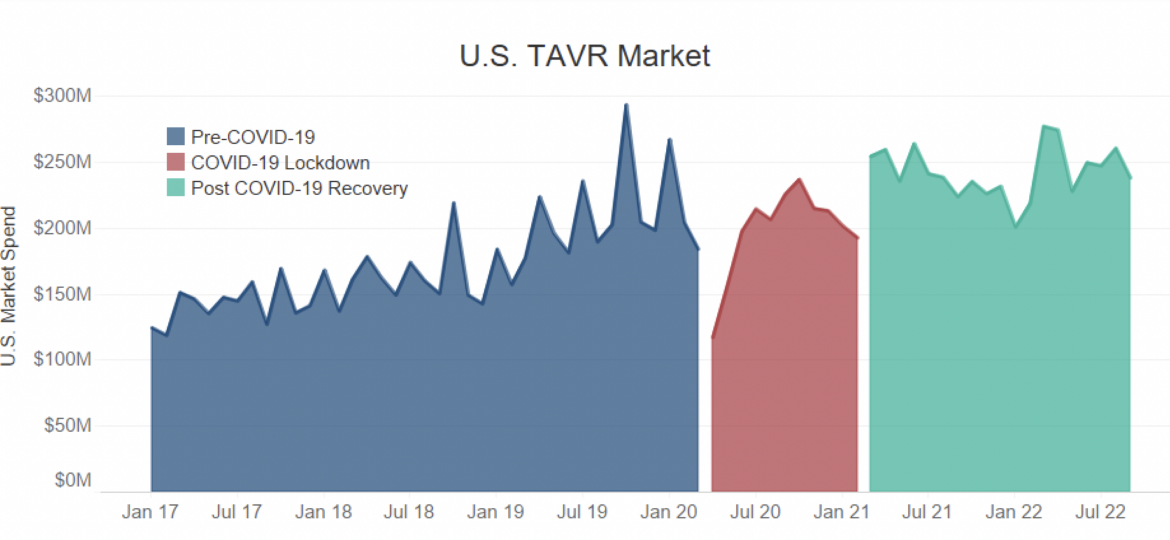

With the leader of the TAVR market, Edwards Lifesciences, reporting a small miss in their third quarter earnings report, Guidepoint Qsight analyzed the short term and long term effects of COVID-19 on the overall U.S. TAVR market.

- The pre-COVID-19 period of TAVR experienced growth as high as 45% in January 2020 as compared to January 2019, attributed to a multitude of factors:

- Expanded indications to low-risk patients, increasing eligibility and availability to a wider audience.

- Increased physician preference of the TAVR procedure as compared to open-heart aortic valve replacement surgery, due to its minimally invasive nature and clinical success.

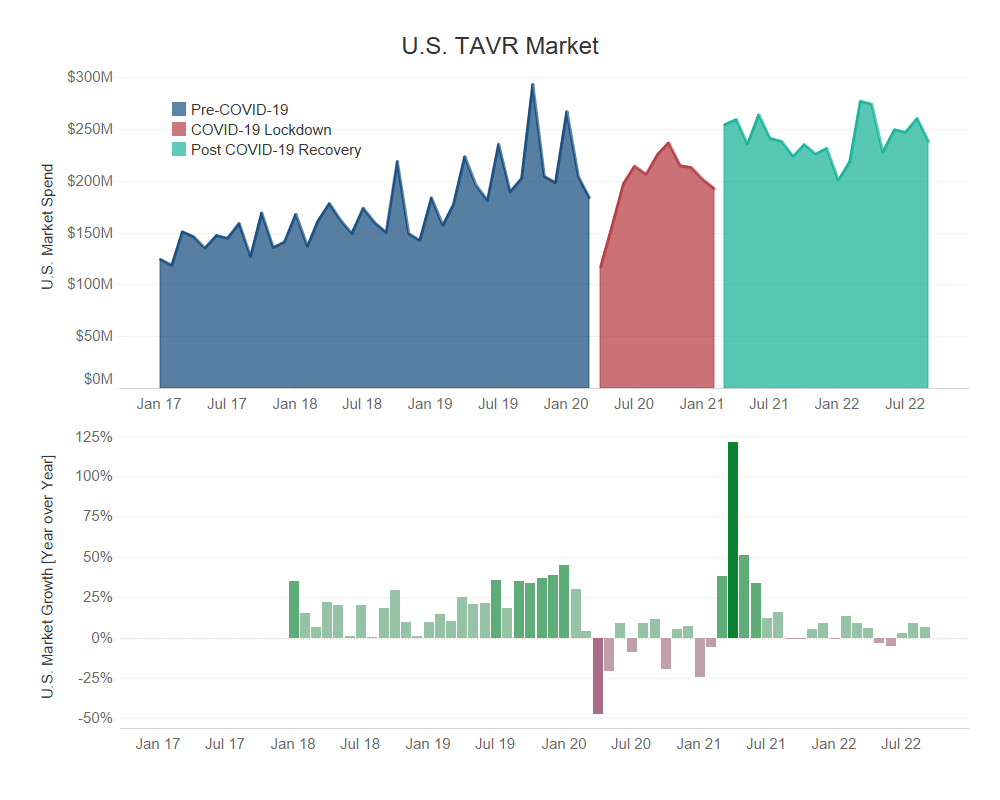

- During the peak of the pandemic, TAVR, like most other deferrable procedures, experienced a disruption in momentum. Despite reaching pre-covid levels by the end of 2020, the resurgence of COVID-19 put a pause on recovery.

- While most other procedures were able to recover from the effects of the pandemic, the U.S. TAVR market is experiencing diminishing growth. This is highly evident in 2022 Q2 as a result of procedure specific nuances and macroeconomic conditions.

- Deferrable procedures have been inconsistently prioritized in hospitals as COVID-19 cases fluctuate, affecting overall procedure volumes.

- Despite being a shorter, less invasive procedure than its alternative, TAVR has a long patient pathway to treatment, leading to delays.

- Macroeconomic factors, such as short staffing and overworked employees, have led to high levels of burn out and staff turnover in healthcare facilities, resulting in increased delays and canceled procedures.

With the TAVR market maturing, and COVID-19 still impacting new procedures, Edwards Lifesciences must find ways to keep up with the ever-changing healthcare landscape.

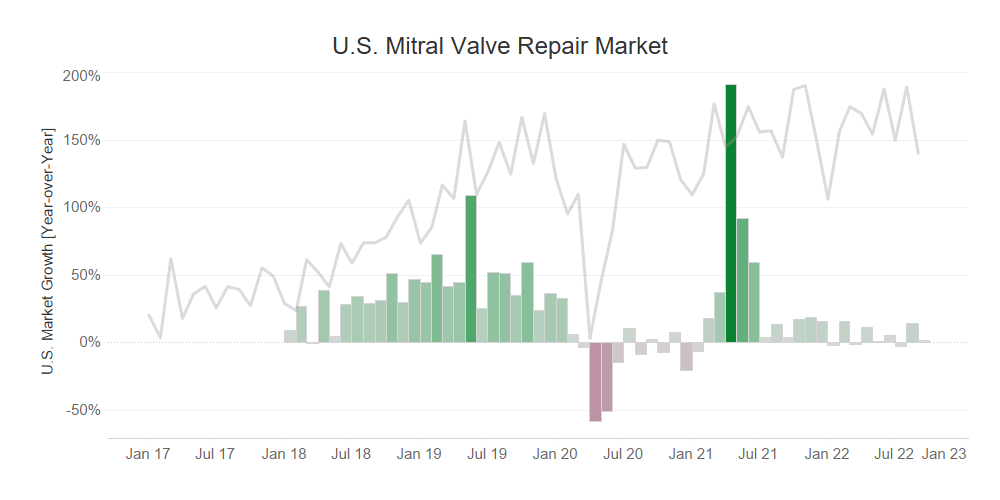

- Edwards recently received FDA approval for PASCAL Precision for the treatment of degenerative mitral regurgitation in September.

- While this portfolio expansion could be positive for Edwards, our data shows that the U.S. Mitral Valve Repair market is undergoing slow market recovery, indicating that this market may not present the growth opportunity Edwards needs.

The above is based on Qsight’s healthcare facilities purchasing dataset analyzing over $1.2B in annual spend from the dominant players in the U.S. heart valve therapies market across a panel of over 500 distinct healthcare facilities and hospitals.

Post Created by Shimul Sheth, VP of Quantitative Research, Guidepoint Qsight and Kenny Dolgin, Director of Quantitative Research, Guidepoint Qsight