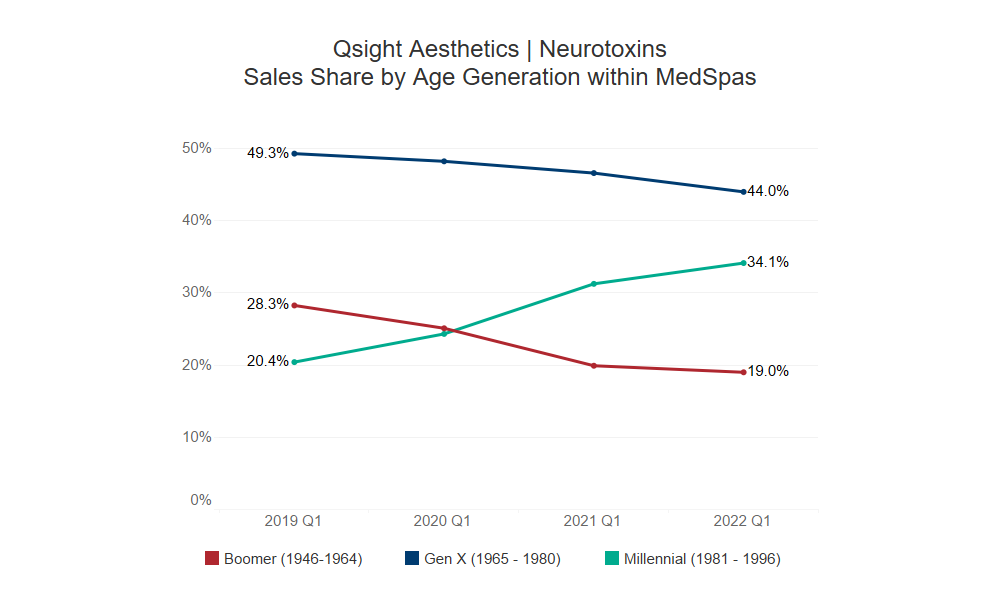

As MedSpas become an important growth driver for the medical aesthetics industry in the U.S., Qsight’s aesthetics point-of-sale data demonstrates how generational spending on neurotoxins appears to be driving a shift in market share among the four U.S. neurotoxin brands.

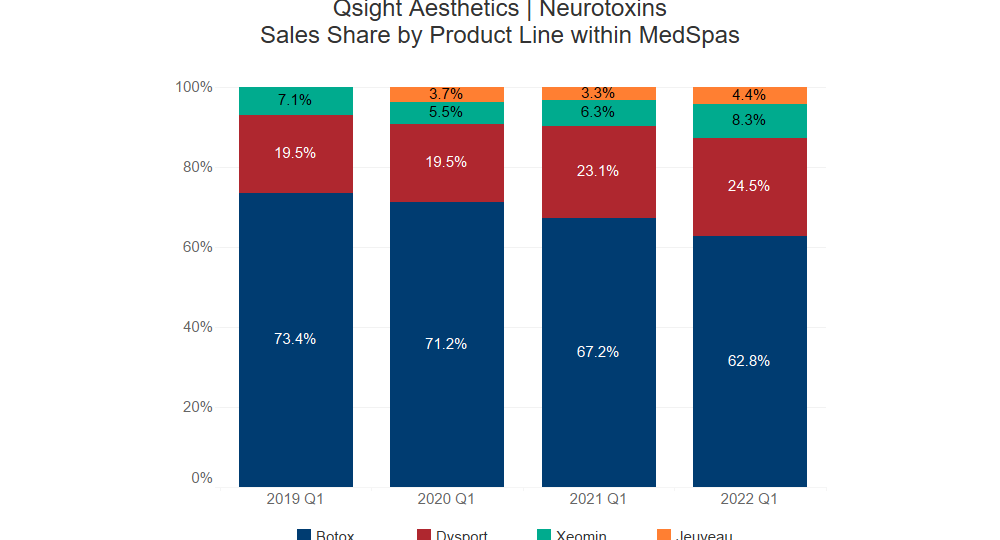

- Allergan’s Botox remains the leader in share of patient spending out of the four main competitors in the Neurotoxin market—Evolus (Jeuveau), Merz (Xeomin), Galderma (Dysport), and Allergan (Botox). However, a practice-level trend analysis from Qsight’s proprietary point-of-sale data shows that Botox has been steadily losing share within the MedSpas segment since 2019.

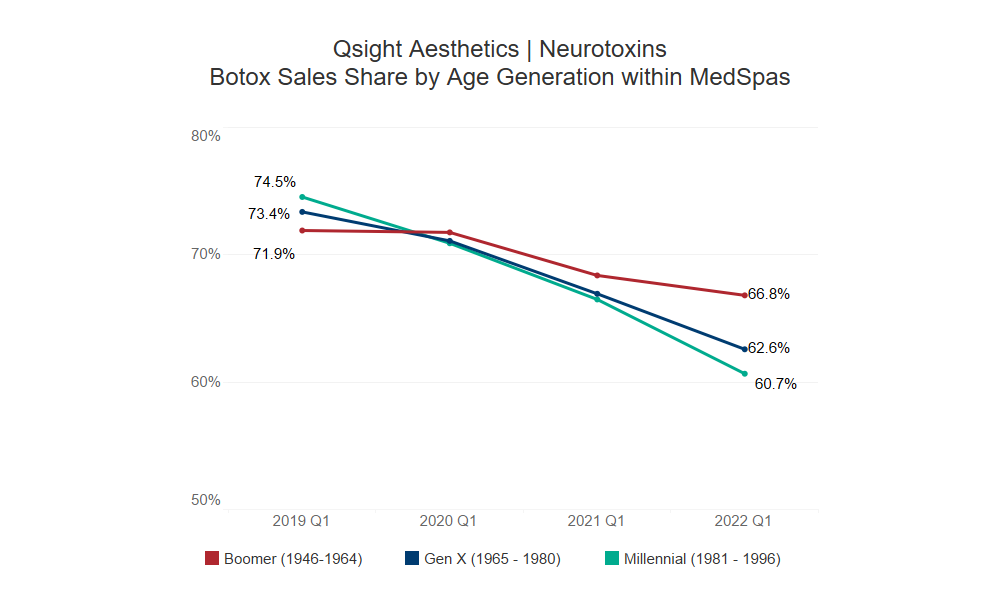

- In addition to losing overall patient spend share in the segment, Botox’s share loss is most pronounced with Millennials (74.5% in 2019 Q1 vs 60.7% in 2022 Q1).

- Neurotoxin sales within MedSpas are increasingly coming from Millennials (up to 34.1% share in 2022 Q1 from 20.4% in 2019 Q1). As a result, this patient group is becoming even more important for the segment and, if this trend continues, could be on pace to become the dominant consumer of injectable aesthetics procedures in the next few years.

The above analysis is based on Qsight’s new Medical Aesthetics Data that analyzes billions of dollars in sales from millions of transactions across hundreds of MedSpas and physician practices in the United States.

Post Created by Shimul Sheth, VP of Quantitative Research, Guidepoint Qsight